The price of Bitcoin has seen a slight uptick of 2% in the last 24 hours, mirroring the overall uptrend in the cryptocurrency market, which has also increased by 2% in total market capitalization.

On-chain analytics suggest that this positive momentum may persist, positioning Bitcoin to potentially reach the $67,000 threshold. In this piece, BeinCrypto delves into the various factors that could facilitate this movement in the near future.

Bitcoin Exhibits Increased Accumulation

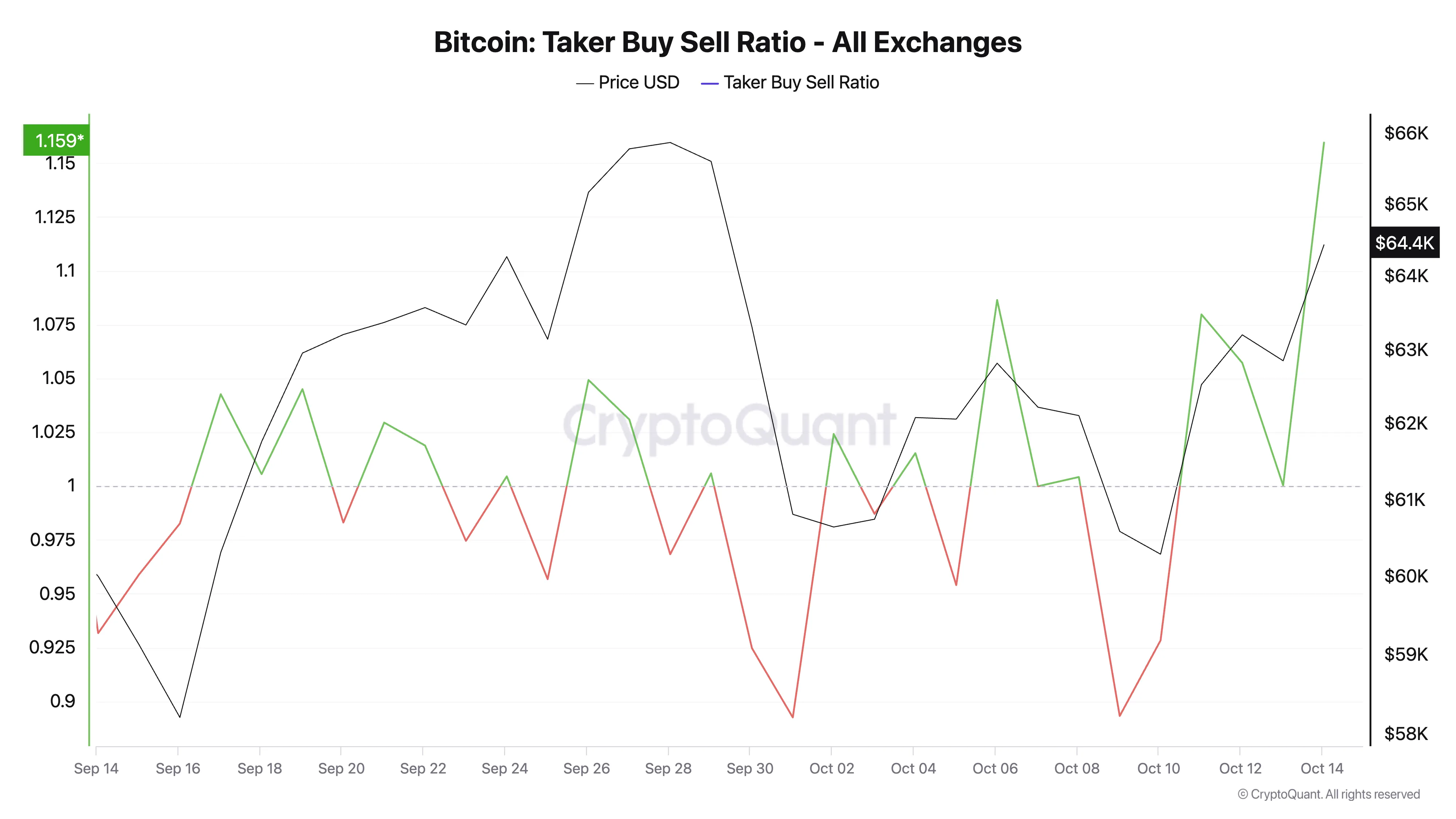

Bitcoin’s taker-buy-sell ratio has climbed to its highest point in the past month, currently recording a ratio of 1.19. This metric assesses the balance of buy versus sell volumes for BTC within the futures market.

Read more: Top 7 Platforms to Earn Bitcoin Sign-Up Bonuses in 2024

A ratio exceeding one indicates a greater number of buyers than sellers, suggesting a bullish market sentiment and rising demand for Bitcoin, which points towards a sustainable upward trajectory.

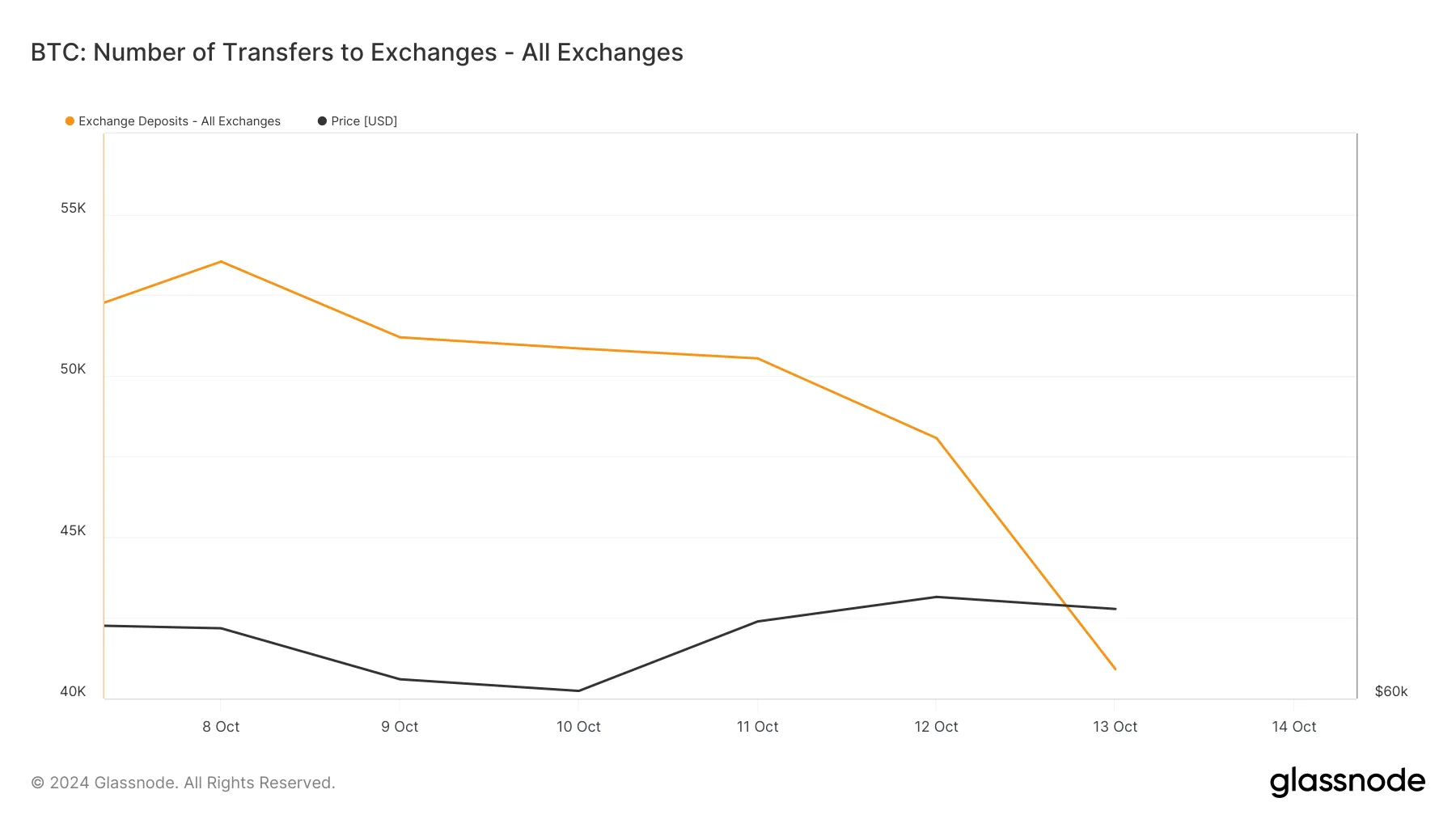

BeinCrypto’s review of exchange activity corroborates this optimistic perspective. Data from Glassnode shows that BTC deposits to cryptocurrency exchanges have dropped to a weekly low of 40,908 coins as of Sunday.

The decline in deposits implies that fewer investors are transferring their assets to exchanges for sale. This trend indicates a strong confidence in Bitcoin’s long-term potential, suggesting that holders anticipate further price increases.

Additionally, the holding time for BTC has surged by 301% over the past week, signifying that coins are being retained longer before transactions occur. This trend serves as a bullish indicator, reflecting traders’ readiness to maintain their investments for extended durations.

BTC Price Forecast: A Surge to a Five-Month Peak Is Feasible

Currently, Bitcoin is trading at $64,315, slightly above the crucial resistance level of $63,289. Should this upward trend continue, a successful re-test of this resistance is likely, paving the way for BTC to aim for $67,078.

If Bitcoin surpasses this level, it could regain its five-month high of $71,906.

Read more: Bitcoin (BTC) Price Predictions for 2024/2025/2030

Nonetheless, this optimistic projection depends on sustained buying activity. Should selling pressures escalate, it may lead Bitcoin’s price down towards $60,627, thereby putting the current bullish scenario at risk.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article serves solely for informative purposes and should not be interpreted as financial or investment advice. BeInCrypto is dedicated to providing accurate and impartial reporting; however, market conditions may shift without prior notice. It is advisable to perform independent research and seek professional counsel before making any financial decisions. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been revised.