Key Points

- The Euro is under heavy selling pressure and traded below 0.8800 against the British Pound.

- There are two important bearish trend lines forming with resistance near 0.8870 on the hourly chart of EURGBP.

- Recently in the UK, the Rightmove House Price Index for Sep 2017 was released.

- The outcome was below the forecast of -1%, as there was a decline in the index by -1.2% (MoM).

EURGBP Technical Analysis

The Euro after a monster upside move found sellers and started a major correction below 0.9000 against the British Pound. The EURGBP pair came under a lot of pressure recently and moved below the 0.8800 support and the 21 hourly simple moving average.

The downside move seems to be very strong below 0.8900. On the upside, there are two important bearish trend lines forming with resistance near 0.8870 on the hourly chart of EURGBP.

An initial resistance is around the 23.6% Fib retracement level of the last decline from the 0.9038 high to 0.8874 low. A break below the recent low of 0.8774 could take the pair towards the 0.8750 support.

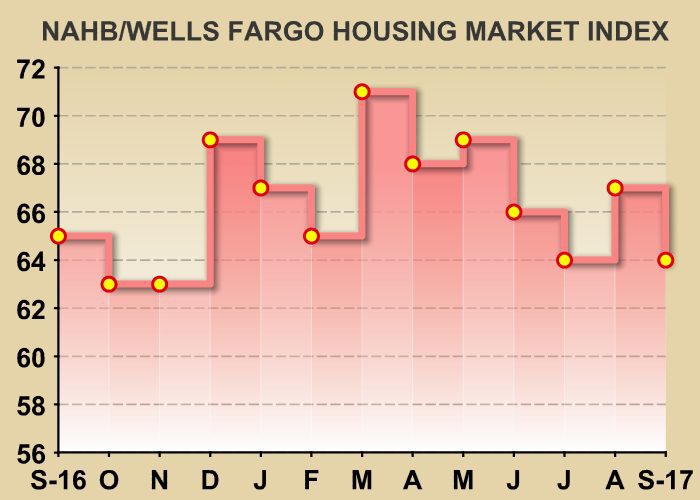

UK’s Rightmove House Price Index

Recently in the UK, the Rightmove House Price Index for Sep 2017 was released. The market was positioned for the House Price Index to decline by 1% compared with the previous month.

The actual result was below the forecast of -1%, as there was a decline in the index by -1.2%. In terms of the yearly change, there was a rise of 1.1%, less than the last +3.1%. The report added that:

Holiday season casts its usual shadow with price of property coming to market falling by 0.9% (-£2,758) this month. Climate of stretched affordability and clouded political outlook continue to chill the annual rate of increase to a national average of just +3.1%.

Overall, the EURGBP pair is very likely to continue trading lower and could even break the 0.8750 support in the near term.