Key Points

- The US Dollar moved down towards 110.20 against the Japanese yen after a failure to break 111.20.

- There is a crucial bearish trend line with resistance at 110.95 formed on the hourly chart of USDJPY.

- Today in Japan, the Labor Cash Earnings figure for Feb 2017 was released by the Ministry of Health, Labour and Welfare.

- The outcome was lower than the forecast, as there was an increase of 0.4% in Earnings in Feb 2017, less than the forecast of 0.5%.

USDJPY Technical Analysis

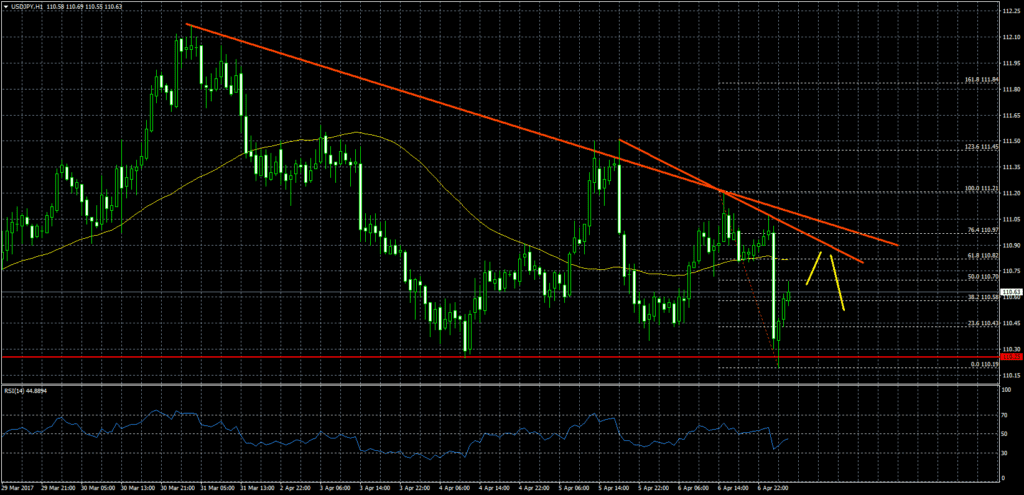

The US Dollar dipped and recovered 2-3 times from the 110.00-110.20 support area against the Japanese yen. The USDJPY pair once again fell towards 110.19, and now recovering towards a major bearish trend line with resistance at 110.95 on the hourly chart.

The same trend line is also positioned above the 21 hourly simple moving average at 110.82, and the 61.8% Fib retracement level of the last decline from the 111.21 high to 110.19 low.

Moreover, the 50% Fib retracement level of the last decline from the 111.21 high to 110.19 low at 110.70 is currently acting as a resistance and preventing a move towards 110.80.

Japanese Labor Cash Earnings

Recently in Japan, the Labor Cash Earnings figure for Feb 2017 was released by the Ministry of Health, Labour and Welfare. The forecast was lined up for an increase of 0.5% in Feb 2017, compared with the same month a year ago.

However, the result was lower than the forecast, as there was an increase of 0.4% in orders in Feb 2017. It was a lot higher, compared with the last rise of 0.3% (revised from +0.5%). In short, the result was not impressive when revisions are considered. The Japanese Foreign-exchange reserves for March 2017 was also released today by Ministry of Finance. The result was neutral with a reading of $1,230.3B.

Overall, the USDJPY pair may rise in the near term towards 110.80, but likely to face resistance near the trend line resistance.