Key Points

- The Aussie dollar declined recently and broke the 0.7620 support area against the US Dollar.

- There was a break below a bullish trend line at 0.7644 on the hourly chart of AUDUSD.

- In Australia today, the Retail Sales report for Feb 2017 was released by the Australian Bureau of Statistics.

- The result was lower than the forecast, as there was a decline of 0.1% in Feb 2017, compared with the forecast of +0.3%.

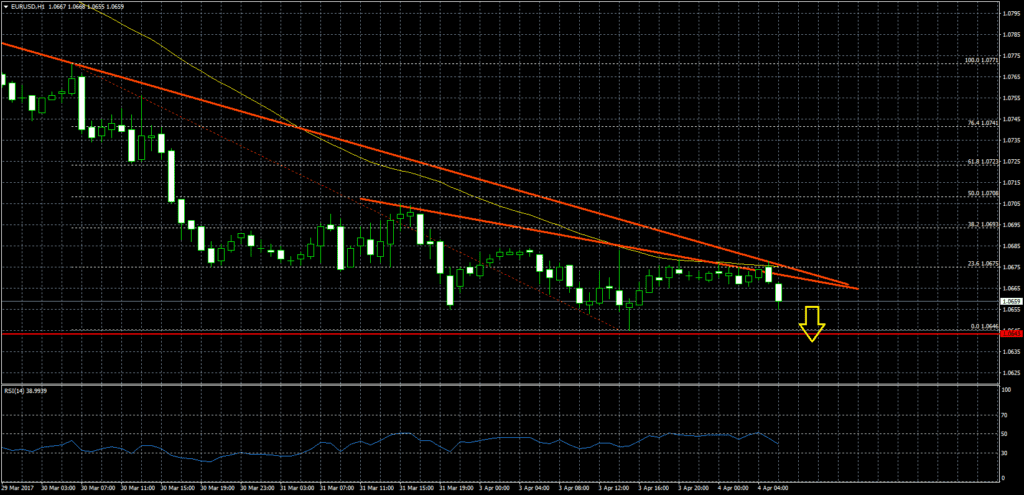

AUDUSD Technical Analysis

The Aussie dollar after trading as high as 0.7680 faced offers, and moved down against the US Dollar. The AUDUSD pair broke a couple of supports at 0.7650 and 0.7640, which ignited a strong downside move.

The pair also broke a bullish trend line at 0.7644 on the hourly chart, and the 21 hourly simple moving average. It is now trading below the 50% Fib retracement level of the last wave from the 0.7587 low to 0.7680 high.

So, there are chances that AUDUSD might decline further, and trade towards 0.7580 in the near term where it could find support.

Australian Retail Sales

Today in Australia, the Retail Sales report for Feb 2017 was released by the Australian Bureau of Statistics. The market was expecting the Retail Sales to increase by 0.3% in Feb 2017, compared with the previous month.

The outcome was lower than the forecast, as there was a decline of 0.1% in Feb 2017. It was also lower than the last increase of +0.4%. The report stated that the “following industries rose in trend terms in February 2017: Food retailing (0.3%), Cafes, restaurants and takeaway food services (0.1%), and Other retailing (0.1%). Clothing, footwear and personal accessory retailing was relatively unchanged (0.0%). Household goods retailing (-0.1%), and Department Stores (-0.1%) fell in trend terms in February 2017 “.

Overall, the AUDUSD has less reasons to move higher, which means it may decline further and retest the last low near 0.7585.