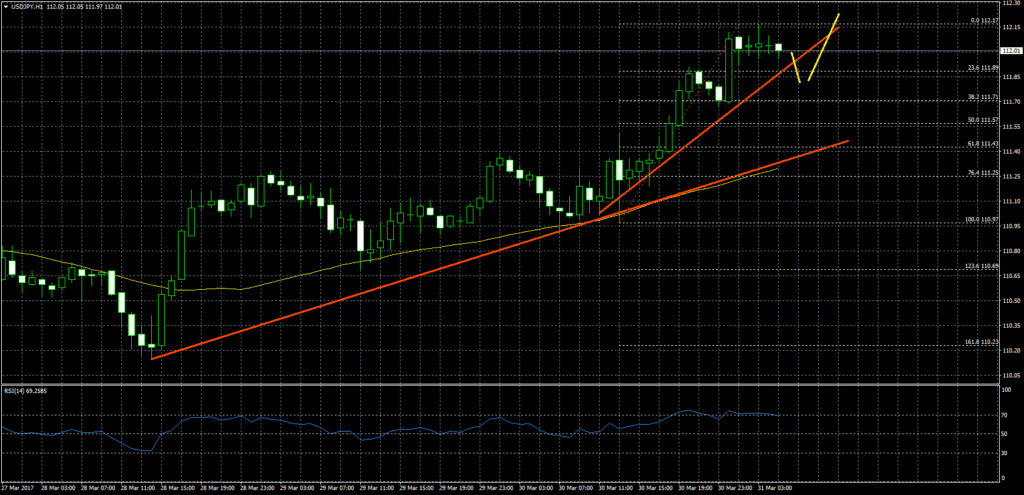

The dollar jumped to its highest in over a week versus its major rivals on Wednesday driven by the outlook on U.S. and European interest rates. Forex investors judged the the selloff following U.S. President Donald Trump's botched healthcare vote as overdone.

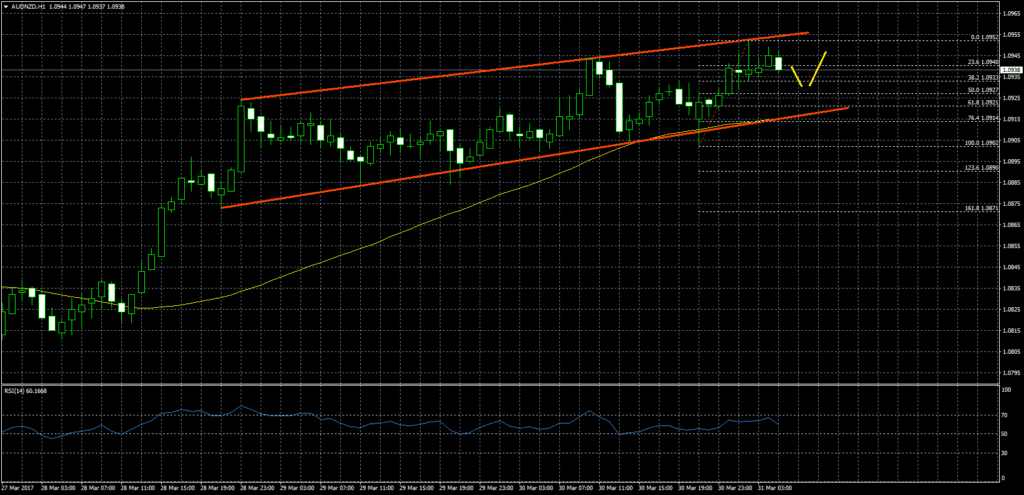

A report by Reuters that European Central Bank policymakers were cautious about changing their policy message after tweaks this month upset traders and raised chances of a surge in borrowing costs.

EUR/USD dipped to 1.0738 following the report, its lowest since March 21. That lifted the dollar index, that tracks the greenback against six of its major rivals, to 100.130, its highest since March 21.

Chicago Fed President Charles Evans, said he supports further rate hikes this year, in line with most of his colleagues. Evans is known as one of the Fed's most consistent supporters of low interest rates.

Interest rates in the United States are higher than the euro zone, which means traders lose money by holding positions that are long euro and short dollar. The Fed recently raised its overnight interest rate to a range of 0.75 to 1.00 percent while the ECB holds negative rates on some deposits.

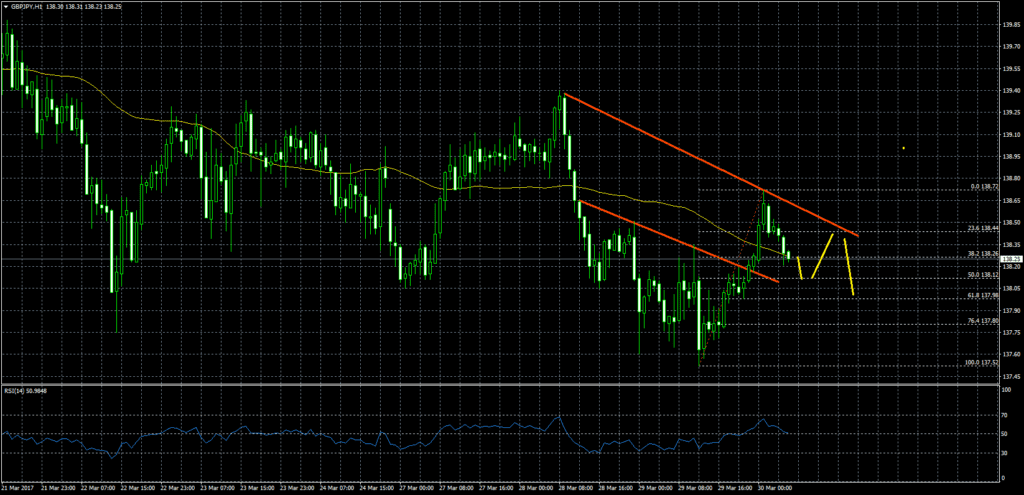

Britain invoked Article 50 on Wednesday, officially beginning its divorce negotiations with the European Union. Cable dropped 0.25 percent and closed at 1.2416.