Key Points

- The Aussie dollar after trading as low as 1.0823 against the Kiwi dollar found support.

- The AUDNZD pair is currently recovering, but likely to face sellers near 1.0890 and two bearish trend lines on the hourly chart.

- Today, the New Zealand Trade balance figure for Feb 2017 (YoY) was released by Statistics New Zealand.

- The result was a bit disappointing, as there was a trade deficit of $-3.79B, a bit more than the last $-3.41B (revised).

AUDNZD Technical Analysis

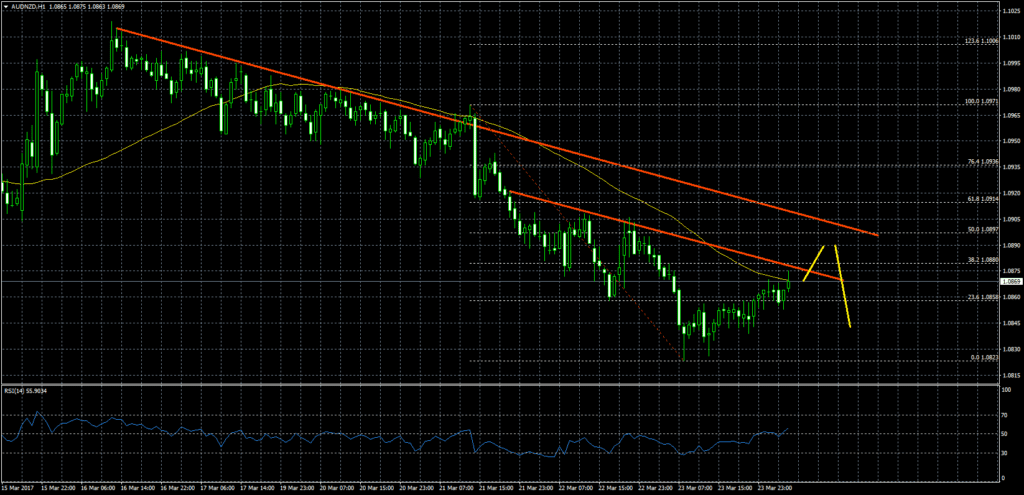

The Aussie dollar after moving below the 1.0850 support against the Kiwi Dollar traded as low as 1.0823. Later, it found support and moved higher, and moved above the 23.6% Fib retracement level of the last decline from the 1.0971 high to 1.0823 low.

At the moment, the pair is struggling to break the 21 hourly simple moving average at 1.0870. However, there many hurdles on the upside, including two bearish trend lines on the hourly chart near 1.0900.

So, if the pair moves higher, it is likely to face offers near 1.0880 and 1.0900.

New Zealand Trade Balance

Today the New Zealand Trade balance figure for Feb 2017 (YoY) was released by Statistics New Zealand. The market was expecting a trade deficit of around $-3.50B in Feb 2017, compared with the same month a year ago.

The outcome was a bit disappointing, as there was a trade deficit of $-3.79B, a bit more than the last $-3.41B (revised). New Zealand Imports were $4.02B, and exports were $4.01B in Feb 2017. The report added that “Goods exports fell $232 million (5.5 percent) to $4.0 billion. Excluding the export of a large drilling platform, goods exports showed little change, up $35 million (0.9 percent). Milk powder, butter, and cheese rose $55 million (5.6 percent)”.

Overall, the AUDNZD pair might trade a few pips higher in the short term, but faces major hurdles near 1.0880 and 1.0900.