Key Points

- The Euro after tumbling towards 1.0528 against the US Dollar found support, and recovered.

- The EURUSD pair broke two bearish trend lines with resistance near 1.0545 formed on the hourly chart.

- Today in the Euro Zone, the French Nonfarm Payrolls for Q4 2016 (QoQ) was released by INSEE.

- The result was around the forecast, as the French Nonfarm Payrolls came in a 0.4%, just as the market expected.

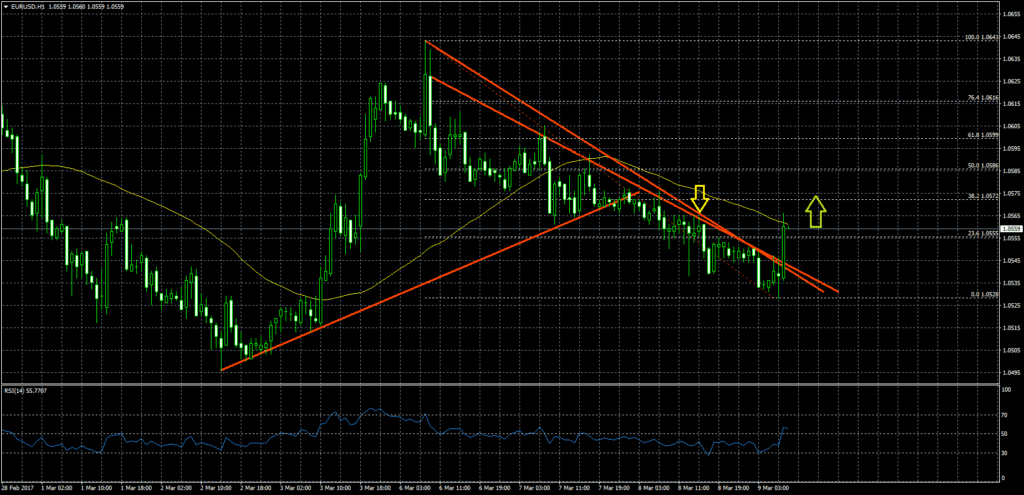

EURUSD Technical Analysis

The Euro was under a lot of pressure, taking it below the 1.0580 support area against the US Dollar. The EURUSD pair traded as low as 1.0528 from where it recovered and moved above the 23.6% Fib retracement level of the last decline from 1.0643 high to 1.0528 low.

During the upside move, the pair broke two bearish trend lines with resistance near 1.0545 formed on the hourly chart, opening the doors for more gains.

However, the pair needs to break the 21 hourly simple moving average at 1.0565 and the 38.2% Fib retracement level of the last decline from 1.0643 high to 1.0528 low to gain further momentum.

French Nonfarm Payrolls

Today in the Euro Zone, the French Nonfarm Payrolls for Q4 2016 (QoQ) was released by INSEE. The market was expecting the Nonfarm Payrolls to increase by 0.4% in Q4 2016, compare with the previous month.

The outcome was around the forecast, as the French Nonfarm Payrolls came in a 0.4%, similar to the last +0.4%. The report stated that “payroll employment in the non-farm market sectors continued to increase (+64,400 jobs, that is 0.4%, after +50,500 jobs in the previous quarter). This is the seventh consecutive quarter of rise”.

Overall, if the EURUSD pair surpass the 21 hourly SMA, it may climb further higher towards the 1.0600 level.