Key Points

- The Euro made a downside move recently and broke the 120.40 support area vs the Japanese yen.

- There was a contracting triangle support at 120.42 on the hourly chart of the EURJPY pair, which was broken.

- Today in Japan, the Leading Economic Index preliminary reading for Jan 2017 was for released by the Cabinet Office.

- The result was above the forecast, as there was an increase from the last revised reading of 104.9 to 105.5.

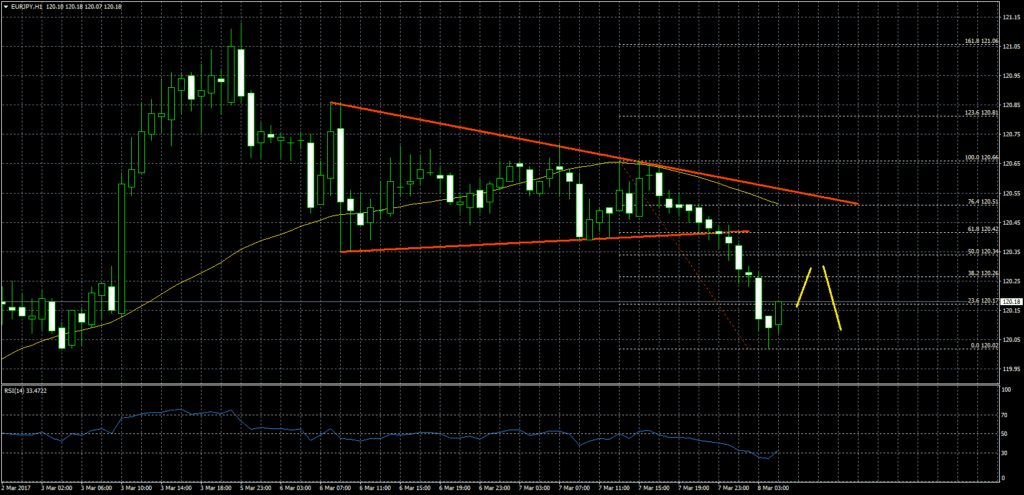

EURJPY Technical Analysis

The Euro after trading in a range and a triangle against the Japanese yen broke down and cleared the 120.40 support area. The EURJPY pair also cleared a contracting triangle support at 120.42 on the hourly chart, opening the doors for a push towards 120.00.

The pair traded as low as 120.02, and currently attempting a recovery. On the upside, it may find sellers near the 38.2% Fib retracement level of the last decline from the 120.66 high to 120.02 low.

However, the most important resistance is near 120.40, coinciding with the 61.8% Fib retracement level of the last decline from the 120.66 high to 120.02 low.

Japanese Leading Economic Index

Today in Japan, the Leading Economic Index for Jan 2017 was for released by the Cabinet Office. It is an economic indicator that consists of 12 indexes, and was forecasted to remain stable in Jan 2017.

The outcome was above the forecast, as there was an increase from the last revised reading of 104.9 to 105.5 (preliminary) in Jan 2017. On the other hand, the Coincident Index posted a decline from the last revised reading of 115.6 to 114.9 (preliminary) in Jan 2017. Moreover, the Japanese GDP released earlier today posted a rate of 0.3%, less than the forecast of 0.4%.

Overall, it looks like there is a chance of a recovery in EURJPY, but the pair might find sellers on the upside near 120.30 or 120.40.