Key Points

- The US Dollar recently completed a correction near 0.9955 against the Swiss Franc, and moved back higher.

- The USDCHF pair is likely heading higher, and could break the last swing high of 1.0006.

- Today in the US, the Consumer Credit figure was released by the Board of Governors of the Federal Reserve.

- The result was on the lower side, as the credit change was $14.16B in Dec 2016, compared with the forecast of $20.00B.

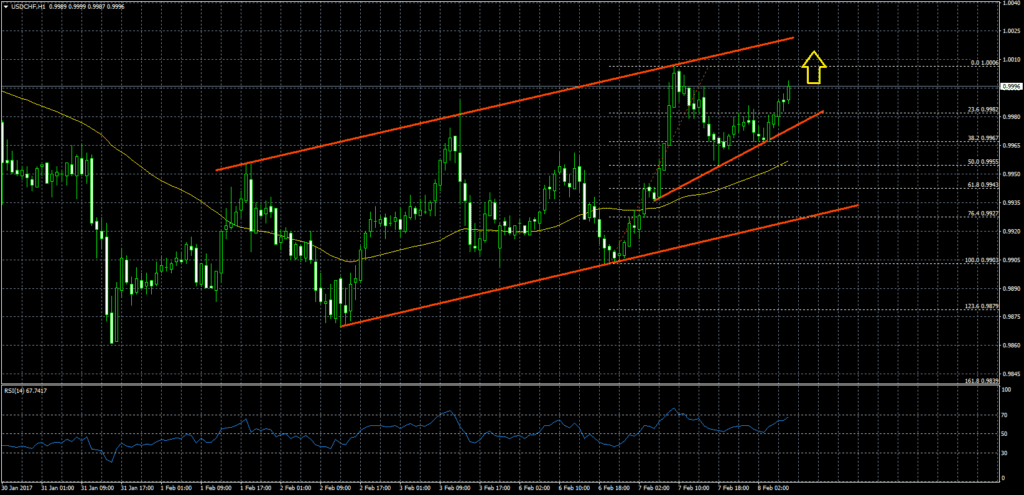

USDCHF Technical Analysis

The US Dollar recently failed to break the 1.0 level and corrected lower towards 0.9955 against the Swiss Franc. The USDCHF pair found support on the downside near the 50% Fib retracement level of the last wave from the 0.9903 low to 1.0006 high.

The pair started trading higher once again, and likely approaching the 1.0 handle again. There is also an ascending channel resistance near 1.0020, which might also act as a resistance.

On the downside, there are many support levels like 0.9980, the channel support trend line and the 21 hourly simple moving average at 0.9955.

US Consumer Credit Change

Recently, the US Consumer Credit Change, which is an amount of money that individuals borrowed was released by the Board of Governors of the Federal Reserve. The market was expecting a change of $20.00B in Dec 2016.

However, the result was on the lower side, as the credit change was $14.16B in Dec 2016. The report added that “Revolving credit increased at an annual rate of 6-3/4 percent, while nonrevolving credit increased at an annual rate of 5-3/4 percent. In December, consumer credit increased at an annual rate of 4-1/2 percent”.

Overall, the US Dollar is trading with a positive bias, and likely to trade further higher in the short term vs the Swiss Franc towards 1.0020.