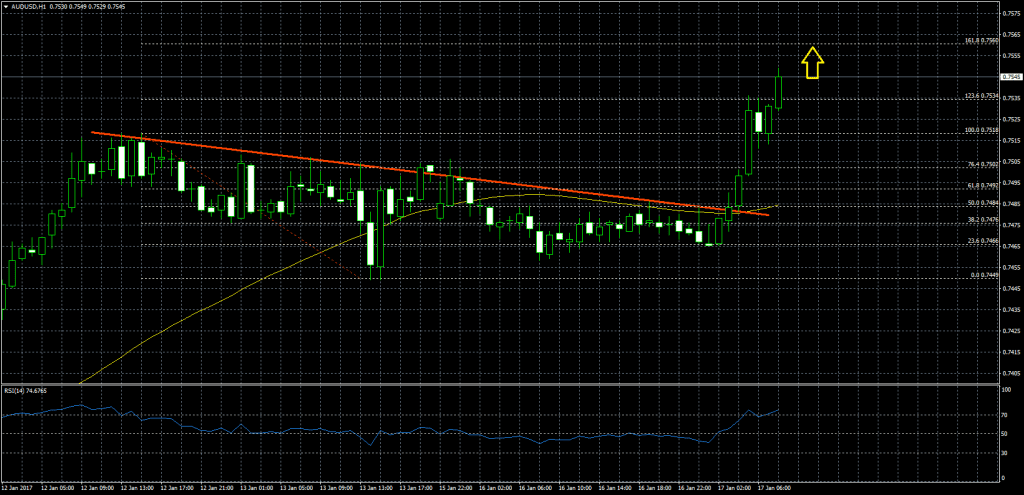

The US Dollar index, an index gauguing the strength of the Dollar against a basket of other currencies, has remained within the 101 region. Unable so far to resume higher levels as we move closer to the presedential inauguration ceremony next Friday and as Trump’s protectionist policies continue to make news.

USDJPY is revolving around113.79 at the time of writing, these levels represent close to 1-month highs in fact. Event risk has given the JPY the upper hand against the US Dollar and we see the JPY in the lead for the 7th consecutive day.

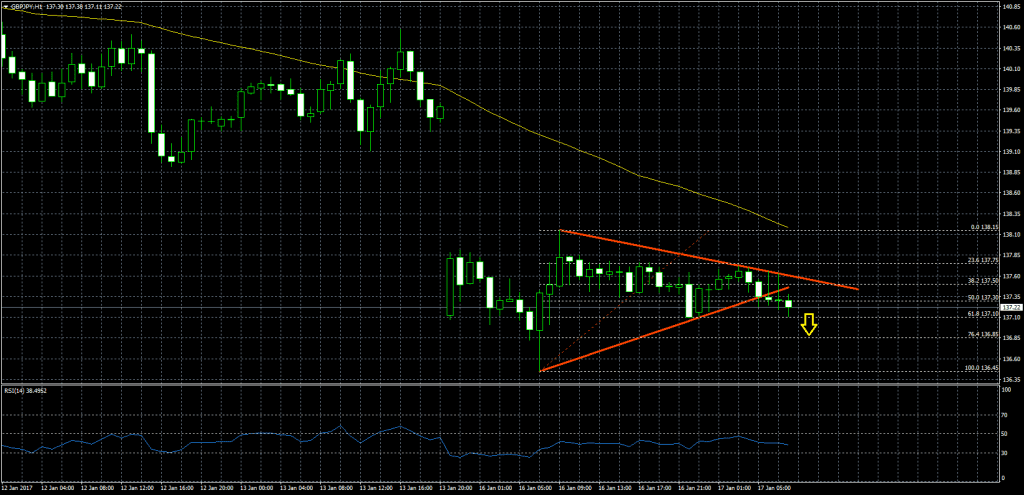

Today the British Prime Minister Theresa May is expected to outline further details on the expected approach to Brexit, and that is likely to keep volatility going. May is expected to hive her speach around 1200 CET today.

The British PM has been highlighting that a “half in, half out” option is no solution and Britain is poised to prefer border control over access to the single market. The EU has made it clear that the four freedoms setting the basis of the union are not negotiable.

Euro has found some good support this morning, the single currency is up across the board. The EURUSD is taking the cue from the volatility surrounding the Pound and the USD at the moment. EURUSD is currently at 1.0644 after today’s open at 1.0595.

Watch out for today’s reading of the UK CPI in the morning, and the German Zew Survey later this afternoon.