Key Points

- The Euro was in an uptrend against the British Pound until it found sellers near 0.8760.

- The EURGBP pair moved down below 0.8700, and almost broke a bullish trend line on the hourly chart.

- Today, the French Consumer Price Index report was released by INSEE.

- The result was around the market expectation, as there was a rise of 0.3% in the CPI in Dec 2016, compared with the previous month.

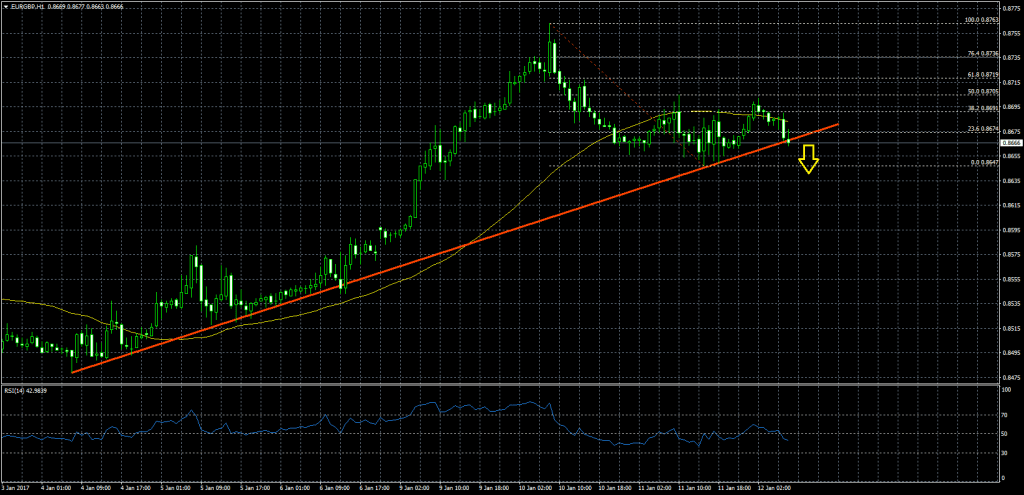

EURGBP Technical Analysis

The Euro jumped towards 0.8760 against the British Pound where it found sellers, and started moving down. There was a downside move, taking the EURGBP pair below the 0.8700 support and the 21 hourly simple moving average.

The pair is currently struggling to hold a bullish trend line on the hourly chart at 0.8660, and may break it soon for more declines.

On the upside, the 21 hourly SMA may now act as a resistance at 0.8675 loss. As long as the pair is below the stated level, there are chances of a break for a move towards 0.8640 at least.

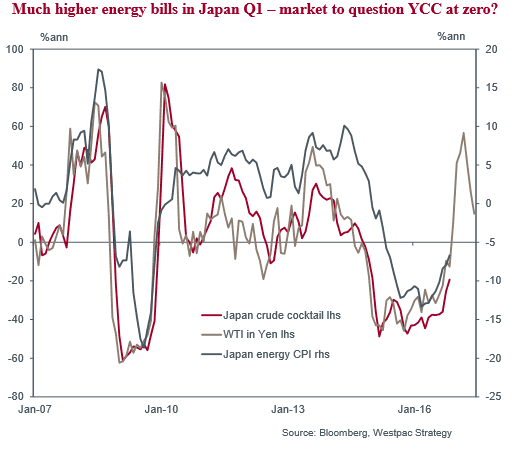

French Consumer Price Index

Today during the London session, the French Consumer Price Index, which is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services was released by INSEE. The market a rise of 0.3% in Dec 2016, compared with the previous month.

The result was around the market expectation, as there was an increase of 0.3% in the CPI. Moreover, the yearly change in the CPI was +0.8% in Dec 2016, which was again as per the forecast.

There was nothing to cheer for the Euro buyers, suggesting the chances of a break in EURGBP below 0.8660 area are a lot more in the near term.