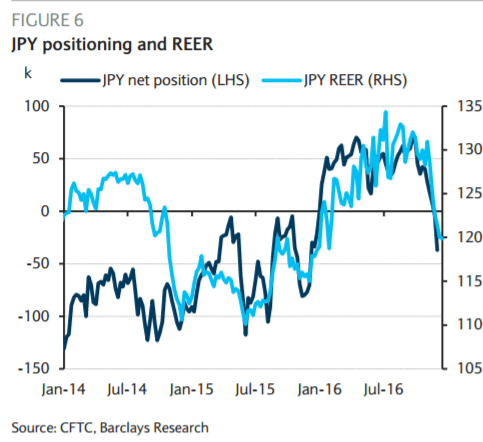

The yen has weakened in part reversing some of the safe haven gains which following yesterday’s tragic events. The yen has also been undermined in part by the BoJ’s decision overnight to leave its monetary policy stance unchanged.

The BoJ remains committed to targeting the 10-year JGB yield at around 0% and continues to signal that it will purchase JGBs at an annual pace of about JPY80 trillion. The decision to leave monetary policy unchanged was in line with consensus expectations although there had recently been some speculation in the run up to today’s meeting that the BoJ may lift the yield target. By leaving the yield target unchanged it may help to ease some of the upward pressure on yields in the near-term and continue to support the sharp widening of yield spreads between Japan and overseas which has weighed heavily on the yen in recent months. We do not expect the BoJ to raise the yield target in the near-term, which is more likely to increase the pace of JGB purchases and/or carry out fixed-rate JGB purchase operations if deemed necessary to dampen yields.

BoJ Governor Kuroda’s comment that the yen is not “excessively weak” will likely reinforce current bearish sentiment towards the yen by signalling they have a tolerance for further weaknes.

Copyright © 2017 BTMU, eFXnews™Original Article