We reiterate our AUDUSD forecasts of 0.74 in 3m and 0.72 in 12m, and our NZDUSD forecasts of 0.685 in 3m and 0.667 in 12m.

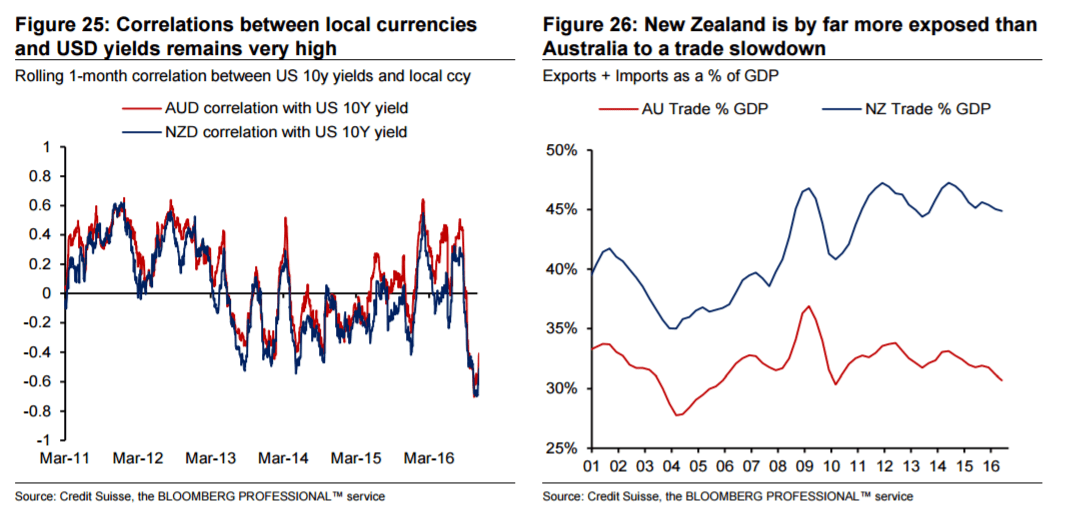

The vast forces and prospects of global regime change unleashed by the election of Trump have not left the Antipodeans unscathed by the aftermath. Our bearish forecasts are closer to being realized as a consequence of the broadly USD positive reasons we discussed previously in the Compass, while the local drivers have been decidedly mixed. So while the themes behind our forecasts have changed somewhat, the forecasts themselves have not.

The level of AUD and NZD is unlikely to provoke a central bank reaction, for now.The role of the strong USD is also clearly visible when comparing AUDUSD and NZDUSD to their TWI counterparts. Figure 28 highlights the extent of the underperformance of the USD-denominated crosses as other currencies (CNY in particular) have similarly depreciated.

Thus, while the RBA and RBNZ will welcome currency underperformance, it is somewhat offset in their calculations by relative weakness among major trading partners. However, neither central bank is likely to be seriously worried at the current levels of their currencies (RBNZ McDermott’s comments regarding intervention should be discounted), and they will be focusing instead on prospective Fed hikes and USD strength to tame their currencies strength instead.

Credit Suisse's forecasts last updated on eFXplus on Nov 16.

Copyright © 2016 Credit Suisse, eFXnews™Original Article