The US Dollar (USD) inched higher against the Canadian Dollar (CAD) on Tuesday, increasing the price of USDCAD to more than 1.3400 but the pair remains vulnerable because of repeated rejections at 1.3560 resistance area. The technical bias remains slightly bullish because of a Higher High in the recent upside rally.

Technical Analysis

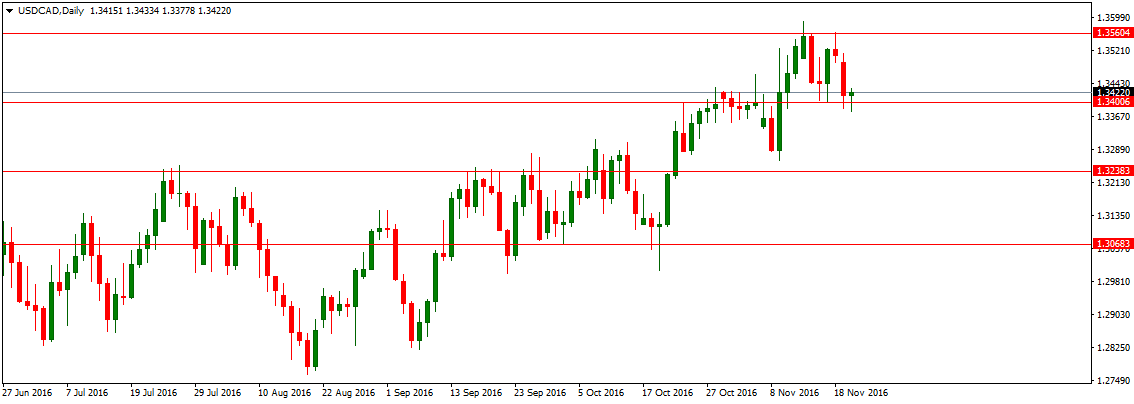

As of this writing, the pair is being traded near 1.3417. A support can be seen around 1.3400 which is the confluence of psychological number as well as a short term horizontal support area as demonstrated in the given below daily chart. A break and daily closing below the 1.3400 support shall incite renewed selling interest, validating a move towards the 1.3238, a major horizontal support.

On the upside, the pair is likely to face a hurdle around 1.3513, the intraday high of yesterday ahead of 1.3560, the horizontal resistance area and then 1.3588, the swing high of the last major upside rally. The technical bias shall remain bullish as long as the 1.3263 support area is intact.

Canada Retail Sales

Retail sales in Canada climbed in September on strong demand for new cars. Excluding the auto sector, sales were flat in the month. The value of retail sales rose in September to a seasonally adjusted 44.38 billion Canadian dollars ($33.08 billion), Statistics Canada said Tuesday. That matched market expectations, as provided by economists at Royal Bank of Canada.

Trade Idea

Considering the overall technical and fundamental outlook, selling the pair on short term upside waves could be a good strategy in medium term. For binary options trading, buying put options near 1.3420 can be a good strategy. We recommend Signals365 in order to get good quality binary options signals.