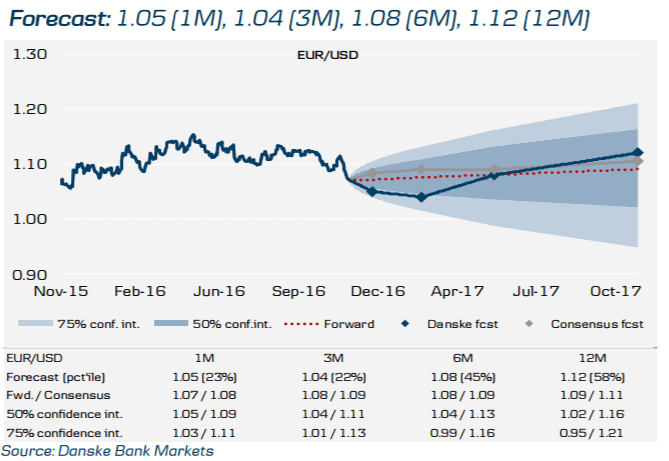

We lower our EUR/USD forecasts to 1.05 in 1M (1.09 previously), 1.04 in 3M (1.08), 1.08 in 6M (1.11) and 1.12 in 12M (1.15).

Over the next one to three months, we expect the prospect of a more hawkish Fed, expectations of a ‘Homeland Investment Act (HIA) 2’ and rising European political risks to drive EUR/USD lower. In particular, we believe uncertainty with respect to HIA is substantial and will have a significant impact on the outlook for the USD. However, there is currently a high degree of uncertainty about the implementation of HIA.

Longer term, we maintain our long-held view that the undervaluation of the EUR and the wide eurozone-US current account differential are EUR positives. Historically, larger US fiscal deficits if not accompanied by a rise in real interest rates are bearish for the USD (see next page). In addition, the Fed may become worried about the strength of the trade-weighted dollar which will mitigate rate increases.

Danske's Forecasts last updated on eFXplus on Nov 16.

Copyright © 2016 Danske, eFXnews™Original Article