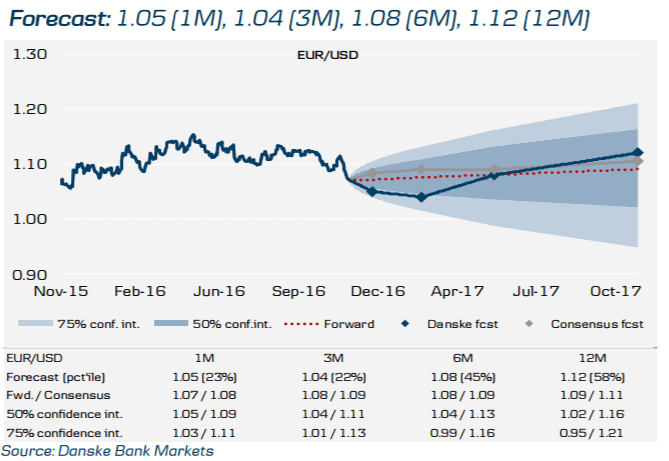

The FX markets have welcomed the Trump victory preferring to focus on the prospects for fiscal stimulus and reduced political gridlock in DC while downplaying the significance of Trump’s populist and often radical views on migration and protectionism. The rise of Western populism will remain an important driver of G10 FX markets, however. Most recently, EUR has been caught in the centre of the political storm that started with the Brexit vote in the UK and now threatens to engulf the Eurozone ahead of the Italian referendum on 4 December, and the general elections in France, the Netherlands and Germany in 2017.

Political risks should drive price action in the EUR-crosses in the coming days with investors focusing on the outcome of the French Centre-right’s primaries this coming and next Sunday. Indications that Alain Juppe will lead the party into the presidential elections to face the resurgent populist Marine Le Pen could help EUR recoup some losses. Cautiousness ahead of the Italian referendum should continue to cloud the EUR outlook, however. We also suspect that President Draghi will reiterate next week that the ECB can extend its monetary stimulus if needed in December. That could keep EUR under some pressure but support risk sentiment.

USD continues to reign supreme but we suspect that the rally may be getting closer to a point where concerns about a premature and unwarranted tightening in US financial conditions are starting to outweigh the positives related to more upbeat growth and inflation expectations after the Trump win. Next week’s US data calendar may offer little in terms of data releases or Fed speeches to change that. The Fed minutes will be seen as somewhat dated as well. Investors could also start taking profit on USD-longs ahead of the Thanksgiving bank holiday. We took profit on our long USD/JPY position.* (see here)

In the UK, the focus next week will be on the autumn statement, which will detail the Chancellor’s fiscal stimulus plans to boost growth. Investors will likely set the growth-positive impact from lower corporate taxes and growing infrastructure spending against the negatives stemming from growing fiscal deficit and public debt. With many negatives in the GBP price and the UK economic fundamentals still fairly robust, however, the FX markets may choose to emphasize the positives and downplay the negatives, helping GBP consolidate.

*This trade was auto-recorded, tracked, and updated in eFXplus Orders.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article