Key Points

- The US Dollar after a correction towards 1.3400 against the Canadian Dollar found support and traded higher.

- There was a break above a couple of important resistance levels like 1.3510 and 1.3540 in USDCAD.

- Today, the Canadian Consumer Price Index (CPI) will be released by the Statistics Canada.

- The market is positioned for a better CPI reading in Oct 2016 (+1.5%).

USDCAD Technical Analysis

The US Dollar gained traction against the Canadian dollar after trading as low as 1.3400. The USDCAD pair traded higher and broke a bearish trend line formed on the hourly chart at 1.3460, opening the doors for more gains.

The pair also managed to clear a couple of important resistance levels like 1.3510 and 1.3540. It traded as high as 1.3565, and currently correcting lower. An initial support on the downside is at 1.3530, which is act the 23.6% Fib retracement level of the last wave from the 1.3400 low to 1.3565 high.

On the upside, the most important resistance is near 1.3580. Buying dips may be considered as long as the pair is above 1.3500.

Canadian CPI

Today during the NY session, there are a few releases in the US as well in Canada. The main one is the Canadian Consumer Price Index (CPI) will be released by the Statistics Canada.

The market is positioned for the price movements by the comparison between the retail prices to increase by 1.5% in Oct 2016, compared with Oct 2015. The result may impact the Canadian dollar and USDCAD in the short term.

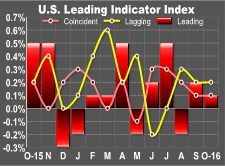

In the US, the Leading Indicators will be released by the Conference Board, which is forecasted to increase by 0.1% in Oct 2016.

Overall, the USD remains in control at the moment, but if the Canadian CPI exceeds the forecast, the USDCAD pair may correct lower.