Key Points

- The British Pound managed to trade higher above the 136.00 handle against the Japanese yen.

- There is currently a minor bullish trend line formed on the hourly chart of GBPJPY, acting as a support near 136.15.

- Today, the UK Claimant Change report was released by the National Statistics.

- The market was expecting a change of 2K in Oct 2016, but it came in at 9.8K, and the last reading was revised to 5.6K from 0.7K.

GBPJPY Technical Analysis

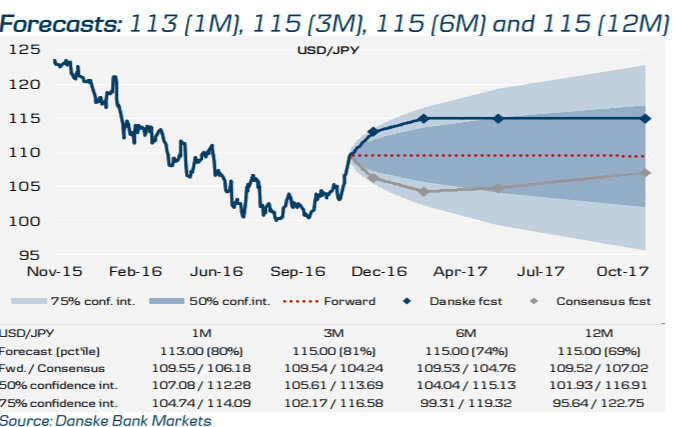

The British Pound traded higher so far this week against the Japanese yen, and broke a couple of important resistances like 135.60 and 136.00. The GBPJPY pair traded as high as 136.75 recently, and currently correcting lower.

On the downside, there is a minor bullish trend line formed on the hourly chart, which may act as a support near 136.15 and provide bids. Moreover, the 23.6% Fib retracement level of the last leg from the 134.19 low to 136.75 high is also around the same trend line.

So, if the pair dips from the current levels, then it is likely to find support near 136.15-00.

UK Claimant Count Change

Today, the UK Claimant Change, which presents the number of unemployment people in the UK was released by the National Statistics. The market was expecting a change of 2K in Oct 2016.

However, the result was disappointing, as the change was 9.8K. The last reading was also increased from 0.7K to 5.6K. On the flip side, the ILO Unemployment Rate dipped from 4.9% to 4.8%. The outcome was disappointing, which is weighing on the British Pound at the moment, but it may be a short-term impact.

Overall, the GBPJPY pair may correct lower in the near term, but as long as it is above 136.00, it remains in an uptrend.