Japan will be the first major market to see the results of the US elections.

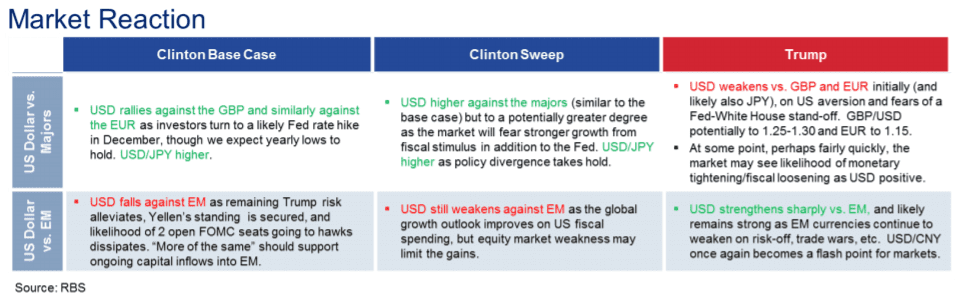

We would posit at least the following four post-election scenarios in terms of fiscal policy expectations, depending on the combination of president and Congress.

(1) Clinton victory + Republican House and Senate: Risk of continued political turmoil. Dead-locked fiscal policies.

(2) Clinton victory + Republican House + Democratic Senate: Somewhat reduced uncertainty. Concern about political situation and fiscal administration.

(3) Trump victory + Republican House and Senate: Heightened expectations for US fiscal policy. Increased global political uncertainty.

(4) Trump victory + Republican House + Democratic Senate: Brake on more aggressive US fiscal policy. Increased global political uncertainty.

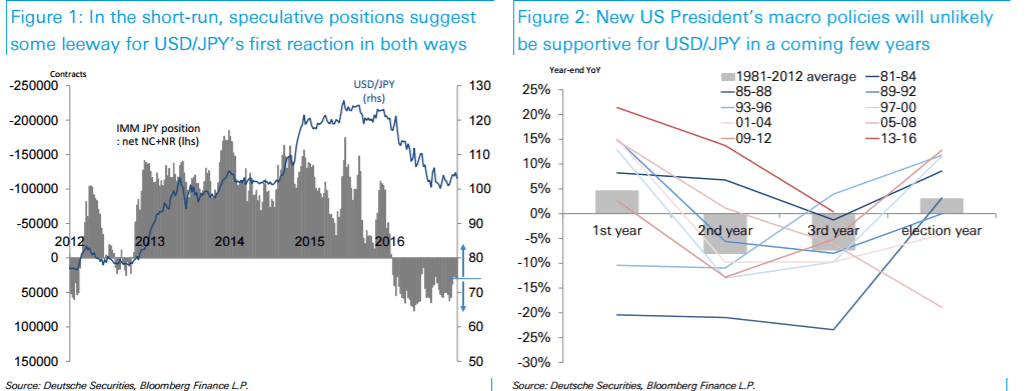

Scenarios (1) and (2) would cast doubt on the sustainability of USD/JPY's uptrend and ultimately result in reversion to a fundamentals-driven market. Today’s news, favorable for Clinton, that the FBI said no evidence against her on the e-mail issue, has already made USD/JPY rebound, which could make the further upside leeway limited. We would recommend selling if USD/JPY rose to around 105 or higher.

In scenarios (3) and (4), we would first focus on whether USD/JPY's initial reaction to risk-off shock from Trump’s victory could make it drop to 100 or lower. A deep decline could result in a greater sales order to cap around the 100 mark. Then, however, USD/JPY could show some steadiness, watching rise in US bond yields and some recovery in stocks to bolder fiscal package expectations. However, from a medium-term perspective, we also see the possibility of USD/JPY falling below 100 before the impact of a Trump administration's fiscal policies would begin to feed through in a few years later. Our tactical approach to USD/JPY would be to sell on Trump-favorable news about the election process, buy back on confirmation of the results of his victory, then gauge the timing to build short positions.

Copyright © 2016 DB, eFXnews™Original Article