Key Points

- The Aussie dollar moved below a major support area of 0.7660 earlier during the Asian session against the US Dollar.

- There was also a break below a crucial bullish trend line formed on the hourly chart of AUDUSD.

- In China today, the housing price index was released by the National Bureau of Statistics.

- The outcome was below the last increase of 9.2%, as it came in at 4.3% in Sep 2016.

AUDUSD Technical Analysis

The Aussie dollar traded lower during the Asian session, and broke a couple of important support levels, including 0.7660. There was also a move below the 21 hourly simple moving average and a crucial bullish trend line formed on the hourly chart of AUDUSD.

The pair is currently finding support, and attempting to move higher. However, the upside may face sellers near the 21 hourly simple moving average.

Moreover, the 38.2% Fib retracement level of the last drop from the 0.7734 high to 0.7618 low might also act as a resistance.

Chinese Hosing Price Index

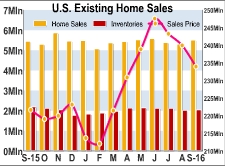

Today in China, the housing price index, which is a key indicator for economy, as rising prices usually encourages new construction, and therefore, growth for the country was released by the National Bureau of Statistics.

The last reading was an increase of 9.2%, and the market was expecting a rise of more than 5% in Sep 2016. However, the result was on the lower side, as there was a rise of 4.3%. Moreover, a report published by the National Bureau of Statistics, stated the “first nine months of 2016, the total retail sales of consumer goods reached 2,797.6 billion yuan, up by 10.7 percent year-on-year (nominal growth rate. The real growth rate was 9.6 percent. The follows are nominal growth rates if there’s no additional explanation)”.

Overall, the Aussie dollar was under pressure, and may continue to face sellers on the upside near 0.7660 vs the US Dollar.