Key Points

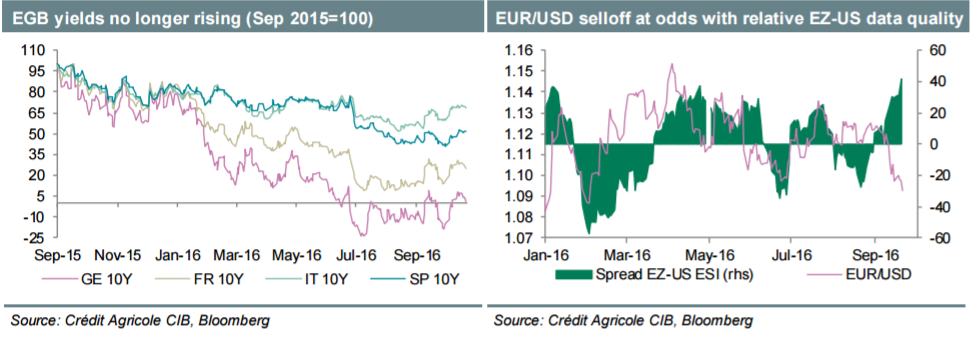

- The Euro remained in a downtrend, and traded below the 1.1000 support against the US Dollar.

- There are a couple of bearish trend lines formed on the hourly chart of EURUSD at 1.0980, acting as a resistance.

- Today, the German Producer Price Index was released by the Statistisches Bundesamt Deutschland.

- The outcome was below the forecast, as there was a decline of 0.2% in Sep 2016.

EURUSD Technical Analysis

The Euro declined recently, and traded as low as 1.0949 against the US Dollar where the buyers just managed to protect the downside. The EURUSD pair is currently recovering, but facing sellers near a couple of bearish trend lines formed on the hourly chart.

The 21 hourly simple moving average, and the 61.8% Fib retracement level of the last decline from the 1.1004 high to 1.0949 low is also around the same area.

So, one may consider selling near the trend line resistance as long as the pair is below the 21 hourly SMA.

German Producer Price Index

Today in the Euro Zone, the Producer Price Index, which measures the average changes in prices in the German primary markets was released by the Statistisches Bundesamt Deutschland. The market was expecting a rise of 0.2% in Sep 2016, compared with the previous month.

However, the result was below the forecast, as the Producer Price Index declined by 0.2%. In terms of the yearly change, there was a decline of 1.4%. The report added that “In September 2016 energy prices decreased by 5.2 % compared with September 2015, prices of intermediate goods fell by 1.2%. In contrast prices of non-durable consumer goods rose by 0.7%, prices of capital goods by 0.6% and prices of durable consumer goods by 1.2%”.

Overall, there is nothing going for the Euro bulls, and they may continue to face offers near 1.0980 in the short term.