Following the downside break of 1.0950 we believe that EUR/USD has further room to fall near-term.

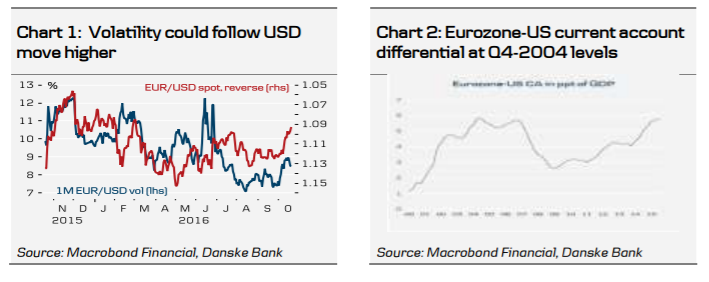

Technically, we could see a further fall towards the 1.0700-1.0850 area. According to IMM data, the market is short EUR/USD but not in stretched territory. As such, this increases the sensitivity of the cross to relative rates, which are bearish for EUR/USD near-term. With little more than a month to maturity, the delta risk profile will rise for an unchanged spot leaving the position increasingly vulnerable to a move lower in the EUR/USD. The 1.0150 sold put option is far out of the money, yet the vega-profile remains negative.

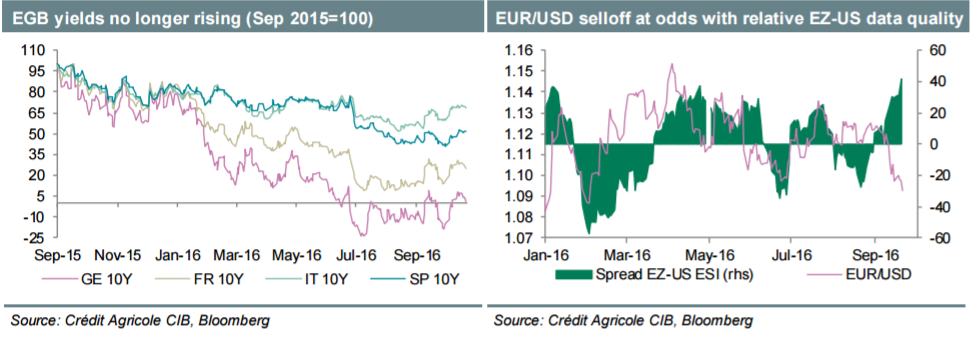

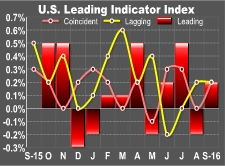

Fundamentals Fundamentally, we are near-term bearish on EUR/USD forecasting the cross at 1.09 in 1M and 1.08 in 3M.Relative growth and rate expectations are bearish for EUR/USD near-term as we expect the ECB to extend QE in December and the market will continue to focus on that the Fed may raise interest rates in the same month. While we expect that the Fed will refrain from raising rates, the prospects of Fed rate increases will remain a market theme supporting the USD.

Medium-term, we remain EUR/USD bull forecasting EUR/USD at 1.11 in 6M and 1.15 in 12M. Our medium-term valuation (MEVA) model continues to support a significantly higher EUR/USD on a 1-2 year horizon. Meanwhile, Eurozone-US current account (CA) differential is at the highest level since Q4-2004 supporting a higher EUR/USD over time.

Copyright © 2016 Danske, eFXnews™Original Article