With the G4 central banks having had their say over the past couple of weeks and top-tier global data out of the way, it is a good time to take stock of our mediumterm and tactical views.

For the medium term, we continue to think that the combination of yield and unchallenging valuations in EM FX looks attractive. Indeed, many of the arguments which motivated our view that EM would finds its feet in 2016 are still intact.

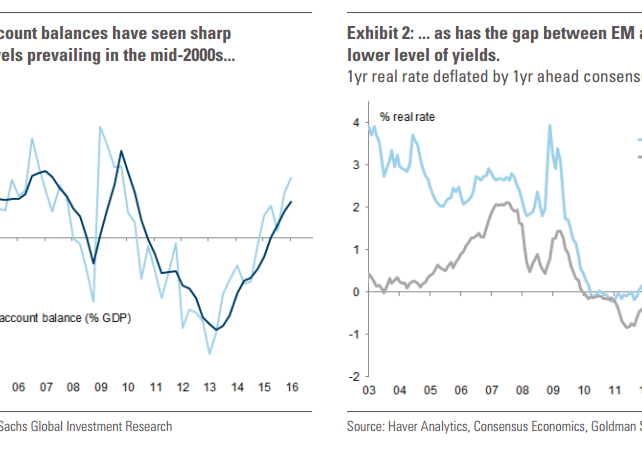

First, as a group, there has been substantial external rebalancing in EM – on average, EM current account balances are not far off the surpluses that prevailed in the mid-2000s (exhibit 1). And even the worst laggards to this process, such as Colombia, are moving in the right direction.

Second, the level of real yield or carry on offer in EM currencies relative to DM, while not quite at the peak levels of the early 2000s or the global financial crisis, has also normalized back to mid-2000 levels (exhibit 2).

Finally, the fundamental improvement in external balances and the sustained depreciation of EM currencies up to 2015 pushed EM FX into undervalued territory at the start of this year. While the rally in 2016 year-to-date has diminished this undervaluation signal, overall EM FX remains an asset with unchallenging valuations and attractive yields in a world of overvalued assets with negative yields.

Copyright © 2016 Goldman Sachs, eFXnews™Original Article