Although we believed 2016 would be a year of yen appreciation, we saw it as corrective strength. While things have gone both right and wrong, our main points are largely unchanged. We believe JPY's weakness has resumed and will manifest into 2017. We expect USD/JPY to rise to 120 – when currency diplomacy will become a serious concern.

Risk reward has shifted from yen buying to yen selling. Multiple forces supported the outlook for a stronger yen this year, but the strongest argument was positioning. Potential USD/JPY buyers almost dried up, while potential sellers accumulated. Of course, whether the yen would appreciate depended on the global macro environment, but the positional skew showed that in terms of potential price range and probabilities, the risk/reward balance was better for yen buying than for yen selling. However, we believe this state of affairs reversed this summer.

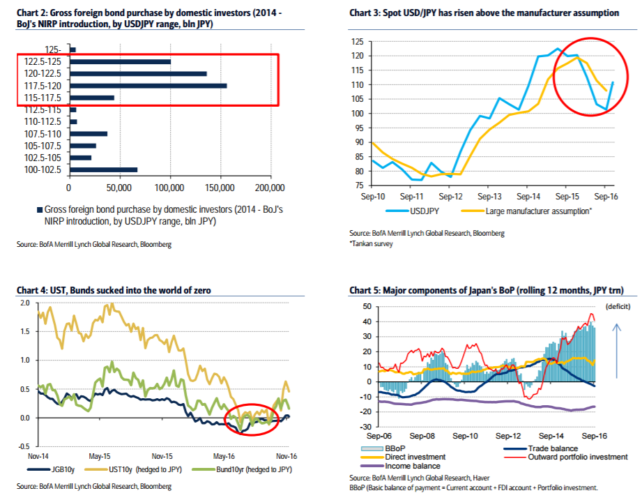

Return of policy divergence. Rising interest rates in the US are pulling up global rates, but the JGB market has largely managed to insulate itself. As such, spreads between foreign and yen rates have widened across the board. In the environment of rising foreign interest rates, the Bank of Japan's yield curve control amplifies its impact on the currency market as long as it remains credible.

Reflation policies continue to be the political tactic. Political incentive to create a better economic environment before a possible snap election – as early as early next year – suggests the probability of fiscal expansion is not low. The BoJ can counter the upward pressure on yields from potential fiscal easing. This could lead to higher inflation expectations and lower real interest rates.

Bullish technical picture. Technical analysis shows USD/JPY made a triple bottom pattern in 3Q16 and began an uptrend in 4Q16. Measured move analysis from the November 2016 trend line break suggests USD/JPY will initially reach 116.48. We also think there is potential for USD/JPY to retest previously important technical levels in 2017 such as 121.15, 123.75 and cannot yet rule out the 2015 highs of 125.85.

Copyright © 2016 BofAML, eFXnews™Original Article