The US dollar’s initial Trump bump has largely been sustained, but the President’s first month in office hasn’t seen any further gains on that front.

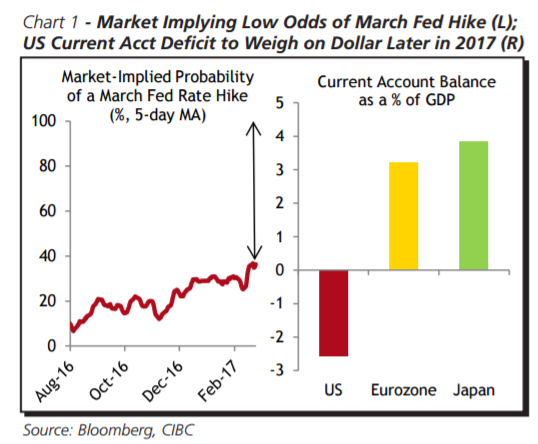

Attention has now shifted back to the central bank to give the greenback another boost, and while, on balance, Fed policymakers look like they have enough evidence to hike rates in March, the market is only assigning a 1 in 3 chance that they move at that meeting. Even if the Fed ends up passing on March, markets need to realize that another rate hike is coming soon, and that will push the US dollar stronger versus a variety of other currencies.

Risks also appear to be tilted to the upside, with the Trump administration still considering protectionist policies which could ultimately give greenback strength additional fuel. While administration officials have stated that they would like to see a weaker currency, actions speak louder than words, and trade policies remain a wild card. But as long as policymakers take a measured approach on that front, which is our base-case expectation, the US dollar is likely to begin losing ground in the second half of the year. That’s when large-scale monetary stimulus could start being pulled back in other places like Japan and the Eurozone.

At the same time, the current account surpluses of those jurisdictions will begin to be seen in starker contrast to the large deficit in the US, adding another layer of pressure to the US currency.

So whether it happens within the next month, or fairly soon thereafter, the US dollar has one more bout of strength left in it before it starts a longer-term slide against a number of other majors.

Copyright © 2017 CIBC, eFXnews™Original Article