Fundamental Forecast for US Dollar: Bullish

Dollar breaks higher versus Euro, 3 key factors favor further strength

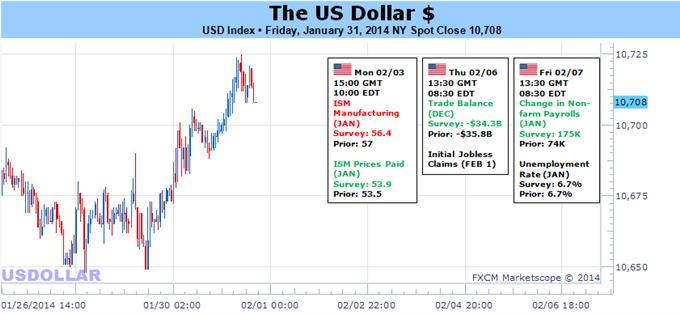

Dow Jones FXCM Dollar Index responds well to key technical support

Key US Nonfarm Payrolls Report may hold the key for USD performance in week ahead

The US Dollar bounced sharply off of recent lows as a fresh round of “Taper” from the US Federal Reserve boosted outlook for the Greenback. Pronounced emerging market turmoil and S&P 500 declines may likewise favor USD gains into a key week of trading.

A highly-anticipated US Nonfarm Payrolls report and three major central bank meetings promise event-driven volatility in the days ahead. Yet it was a handful of not-so-major central banks that drove the biggest financial market moves through the past week of trading.

A fresh currency and banking crisis in Argentina spooked investors in other markets, and we soon saw seemingly-unrelated currencies such as the South African Rand and the Russian Ruble lose ground against the safe-haven US Dollar. EM central bankers hiked rates aggressively in a bid to stabilize their currencies, but in some cases the opposite occurred as investors panicked. Where does this leave us?

Nothing in financial markets exists in a vacuum; further tensions in the EM world could easily affect moves in the Dollar and broader global asset classes. Thus we’ll watch whether pairs such as the USDZAR stabilize in the face of real dangers.

The US Federal Open Market Committee (FOMC) made no reference to EM troubles as it announced a fresh $10B in “Taper” of Quantitative Easing purchases. In doing so the Fed made it fairly clear that it was not especially concerned over market volatility or a dismal December US employment report. All else remaining equal, we believe that consistent Taper from the FOMC will boost the US Dollar versus major counterparts.

The recent FOMC decision and attached statement dispelled a great deal of uncertainty over future policy, but traders will nonetheless watch Friday’s US NFPs report to gauge the likelihood of further Fed tightening. Consensus forecasts call for a modest jobs gain in the January data; December’s sharply disappointing result suggests that hiring should rebound in the first month of 2014. Suffice it to say, two consecutive NFPs disappointments could shake confidence in the US economic recovery and the Dollar.

It will be important to see that upcoming Reserve Bank of Australia, European Central Bank, and Bank of England meetings likewise show little concern over market volatility. Fresh action from the RBA, ECB, or BoE seems unlikely, but traders remain skittish and any surprises in either policy or commentary could spark major moves.

The Dollar seems poised to test fresh peaks versus major counterparts as the Fed tightens policy and markets remain tense. Yet a busy week of event risk and a sharp gain in FX volatility prices suggests that price action could take many turns. Traders may look to keep leverage low and control risk in what promises to be another eventful week for financial markets. – DR

Trade your opinion on the US Dollar via our Mirror Trader currency basket

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx