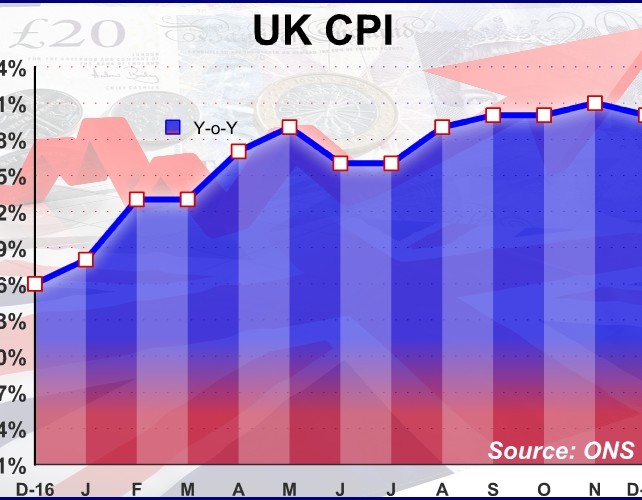

UK inflation slowed for the first time in six months in December, on air fares and recreational goods costs, official data showed Tuesday.

Inflation eased to 3 percent in December from 3.1 percent in November, the Office for National Statistics reported. The rate came in line with expectations and was the first decrease in six months.

The 3.1 percent inflation logged in November was the fastest since early 2012.

The fall-back in inflation probably marks the beginning of a sustained downward trend over the course of 2018, Paul Hollingsworth, an economist at Capital Economics, said. Despite this, the Monetary Policy Committee is set to raise rates several more times this year, the economist noted.

The central bank forecast inflation to slow this year, to 2.4 percent by the fourth quarter. The BoE is expected to keep its key rate unchanged at 0.50 percent at its next meeting on February 8.

Data showed that consumer prices advanced 0.4 percent on month, as expected, in December.

Core inflation that excludes energy, food, alcoholic beverages and tobacco, slowed to 2.5 percent in December from 2.7 percent in November. Inflation was forecast to slow to 2.6 percent.

Similarly, including owner occupiers' housing costs, inflation came in at 2.7 percent versus 2.8 percent in the previous month.

Another report from ONS showed that output price inflation accelerated to 3.3 percent in December from 3.1 percent in November. This was the 18th consecutive month of positive inflation.

Food products displayed the largest annual increase of 6.1 percent in December. Monthly output price inflation remained the same at 0.4 percent.

Meanwhile, input price inflation eased sharply to 4.9 percent in December from 7.3 percent in November. This was the slowest since July 2016.

On a monthly basis, input prices edged up 0.1 percent, much slower than November's 1.6 percent increase. Prices have been rising since August.

At the Treasury Select Committee BoE Deputy Governor Sam Woods said financial exposure of banks and insurers to Carillion was "entirely manageable."

Woods said he personally checked their exposure to Carillion, the construction giant that collapsed Monday.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.