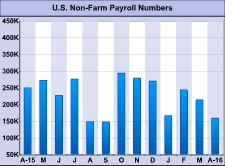

Employment in the U.S. climbed by much less than expected in the month of April, the Labor Department revealed in a closely watched report on Friday.

The report said non-farm payroll employment rose by 160,000 jobs in April compared to economist estimates for a jump of about 200,000 jobs.

Revised data also showed that employment in February and March increased by 233,000 jobs and 208,000 jobs, respectively, reflecting a net downward revision of 19,000 jobs.

Job gains in professional and business services, health care, and financial activities were partly offset by a continued drop in mining jobs. Government employment also decreased during the month.

The Labor Department also said the unemployment rate held at 5.0 percent in April, unchanged from the previous month. The rate had been expected to edge down to 4.9 percent.

The unchanged employment rate came as the labor force tumbled by 362,000 people, while household employment slumped by 316,000 people.

However, Paul Ashworth, Chief U.S. Economist at Capital Economics, said the decreases need to be looked at in a broader context.

"Over the preceding five months, both the household survey measure of employment and the labor force increased by two million each," Ashworth said. "In such a volatile survey, some payback was inevitable."

Meanwhile, the report also showed that average hourly employee earnings rose by $0.08 or 0.3 percent to $25.53 in April.

The annual rate of growth in average hourly earnings subsequently accelerated to 2.5 percent in April from 2.3 percent in March.

"Overall, there is nothing here to swing the Fed's June rate decision very far in either direction," Ashworth said. "We still think the Fed will hike next month, but it's shaping up to be a close call."

The Federal Reserve has left interest rates unchanged at its last three meetings after raising rates for the first time in nearly a decade last December.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Forex News