Employment in the U.S. increased by a little more than economists had been anticipating in the month of November, according to a report released by the Labor Department on Friday.

The report said non-farm payroll employment climbed by 178,000 jobs in November following a downwardly revised increase of 142,000 jobs in October.

Economists had expected employment to increase by about 170,000 jobs compared to the addition of 161,000 jobs originally reported for the previous month.

The stronger than expected job growth was partly due to notable increases in employment in professional and business services and health care and social assistance, which added 63,000 jobs and 34,700 jobs, respectively.

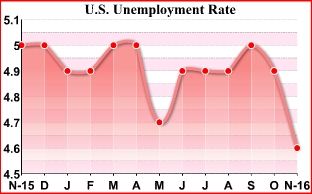

The Labor Department also said the unemployment rate fell to 4.6 percent in November from 4.9 percent in October. The unemployment rate had been expected to remain unchanged.

With the unexpected decrease, the unemployment rate fell to its lowest level since hitting a matching rate in August of 2007.

However, the drop in the unemployment rate partly reflected a decrease in labor force participation, with the participation rate edging down to 62.7 in November from 62.8 in October.

While the household survey measure of employment showed an increase of 160,000, the number of people in the labor force slumped by 226,000.

The report also said average hourly employee earnings fell by $0.03 to $25.89 in November. The annual rate of wage growth subsequently slowed to 2.5 percent from 2.8 percent.

"That weak wage figure will probably raise a few eyebrows among some of the more dovish Fed voters," said James Smith, Developed Markets Economist at ING. "But it would have had to have been a really disastrous jobs report to have derailed the FOMC's plans to hike in December."

He added, "In fact, assuming that the latest wage growth figure was a blip, we still think that the labor market is strong enough to support two hikes from the FOMC next year."

The Federal Reserve is scheduled to hold a two-day monetary policy meeting on December 13th and 14th, with the central bank widely expected to raise interest rates by a quarter point.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News