Malaysia's economic growth accelerated unexpectedly to the fastest pace in more than two years in the second quarter on robust private consumption.

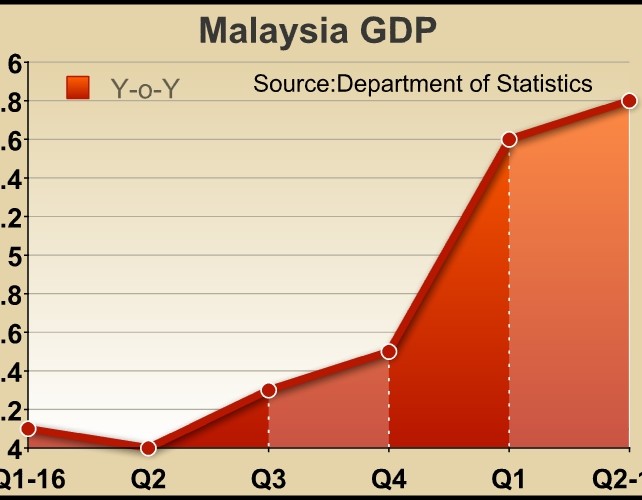

Gross domestic product grew 5.8 percent year-on-year in the second quarter, faster than the 5.6 percent expansion seen in the first quarter, the Department of Statistics reported Friday. The annual rate was forecast to ease to 5.4 percent.

Quarter-on-quarter, GDP growth slowed to 1.3 percent from 1.8 percent in the first quarter.

On the production side, the service sector logged 6.3 percent expansion. Manufacturing climbed 6 percent and the agriculture sector grew 5.9 percent.

The expenditure-side breakdown of GDP showed that private consumption advanced 7.1 percent fueled by the spending on food and non-alcoholic beverages.

At the same time, gross fixed capital formation growth moderated to 4.1 percent from 10 percent in the first quarter.

Exports increased 9.6 percent, but slower than the 9.8 percent increase seen in the first quarter. At the same time, imports gained 10.7 percent due to slower momentum in imports of goods.

Bank Negara Malaysia Governor Muhammad Ibrahim said growth is expected to go beyond the target of 4.8 percent this year.

Despite today's positive surprise, Capital Economics' economist Gareth Leather said growth is likely to slow in the coming quarters due mainly to weaker prospects for domestic demand.

The economist said the economy is unlikely to get any support from fiscal policy and there is little space for monetary policy to offset tighter fiscal policy.

The balance of payment showed a surplus of MYR 9.6 billion in current account compared to MYR 5.3 billion in the previous quarter.

The current account balance increased by MYR 4.4 billion from a quarter ago mainly contributed by higher surplus in goods accounts of MYR 27 billion.

Fitch Ratings affirmed the credit ratings of Malaysia at 'A-' with a 'stable' outlook, on Thursday. The agency said the rating is underpinned by strong GDP growth, sustained current account surpluses and the country's net external creditor position.

However, the rating remains constrained by some structural metrics, including per capita GDP and governance indicators, and government debt.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News