Fundamental Forecast for GBP: Neutral

Pound May Rise as 4Q UK GDP Data Boosts BOE Rate Hike Bets

GBPAUD Weekly Opening Range Setup- Long Scalps at Risk Sub-1.92

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

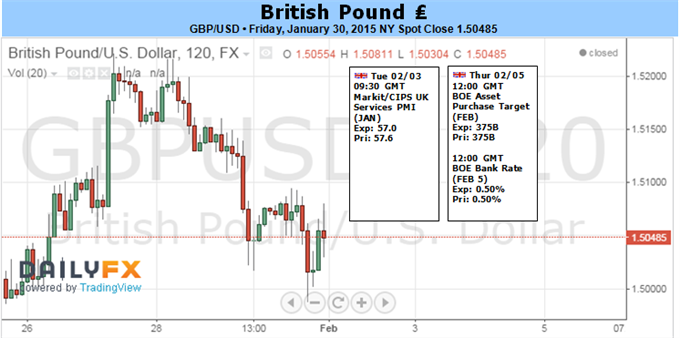

The Bank of England (BoE) interest rate decision may have a limited impact on GBP/USD as the central bank is widely expected to preserve its current policy at the February 5 meeting.

According to a Bloomberg News survey, all of the 41 economists polled anticipate the Monetary Policy Committee (MPC) to retain a wait-and-see approach, and the central bank may once again refrain from releasing a policy statement as it remains in no rush to normalize monetary policy. Even though BoE Governor Mark Carney continues to prepare U.K. households and businesses for higher borrowing-costs, the committee may further delay its normalization cycle especially as price growth undershoots the 2% target.

With that said, the BoE may curb its economic assessment while delivering the quarterly Inflation report on February 12, but we may see a growing number of MPC officials show a greater willingness to raise the benchmark interest rate over the medium-term as the central bank anticipates a stronger recovery to take hold in 2015. In turn, the ongoing improvement in the labor market may continue to encourage expectations for faster wage growth, and the central bank may sound more upbeat this time around as it sees weaker energy prices as a net positive for the U.K. economy.

Nevertheless, GBP/USD may continue to carve a string of lower-highs in the week ahead as market participants speculate the Federal Reserve to normalize monetary policy ahead of its U.K. counterpart, and the pair remains at risk for a further decline over the near-term as the Relative Strength Index (RSI) largely preserves the bearish momentum carried over from the previous year.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx