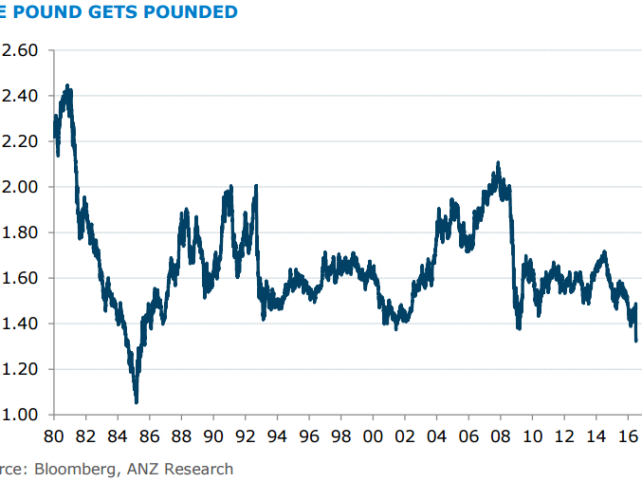

Despite the sharp fall in GBP so far, we still see it as vulnerable to further declines. The downgrade of the UK’s AAA rating to AA (negative) by S&P has added to the negative tone. Markets had overlooked the UK’s growing current account deficit (5.2% of GDP in 2015) previously, but this alongside the uncertainty over its future trade relations and the possibility of rate cuts from the BoE, means it is still too soon to call a bottom for sterling. We have downgraded our GBP/USD forecast as a result, seeing it heading to a lower 1.20-1.25 range over H2 and into next year.

The EUR will not be immune to GBP weakness. In addition, the single currency would be sensitive to any voices calling for referenda on EU membership by other countries looking to follow the UK’s footsteps. We now see the potential for EUR/USD to move to 1.05 or lower, and have downgraded our forecasts as a result.

Copyright © 2016 ANZ, eFXnews™Original Article