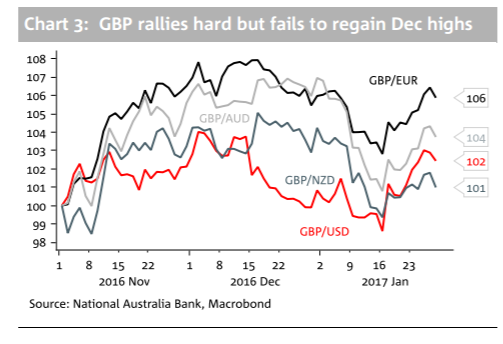

The British Pound has just enjoyed its best two-week performance since April 2015, with January 17th seeing the biggest one-day rally against the US Dollar in almost 8 years.

This hasn’t been driven by uniformly strong economic data: whilst GDP growth in Q4 at 0.6% q/q was a tenth better than consensus estimates, retail sales in December showed the biggest m/m drop in nearly 5 years and the number of people in work is now lower than 3 months ago.

Instead, a combination of short investor positioning and changing political dynamics has given a huge and unexpected boost to the GBP.

The key question is the extent to which this good political news is now already in the price of the pound? The sharp rally in GBP/USD reflects some disappointment with the USD as much as a less bleak near-term outlook for the GBP and, with the better growth and monetary policy outlook in the United States, we expect the USD to now gradually begin to find more investor support.

The December 2016 high of GBP/USD 1.2775 should provide formidable technical resistance to the recent rally and though the Bank of England on Thursday may try to talk tougher on inflation, no-one seriously expects a rate hike at any point over the next 12 months.

As attention now turns to what is officially referred to as the European Union (Notification of Withdrawal) Act 2017, we believe that notwithstanding the improved political backdrop the GBP will struggle to extend its recent gains. A 3% gain on a trade-weighted basis in the space of just 10 trading days is a quite sufficient repricing of the balance of risks.

Copyright © 2017 NAB, eFXnews™Original Article