– Commodity Technical Analysis: Gold Falls Sharply and Leaves Advance in 3 Waves

– Commodities: Gold at Risk of Deeper Losses on US Employment Data

– Commodity Technical Analysis: Gold Probes Short Term Trendline

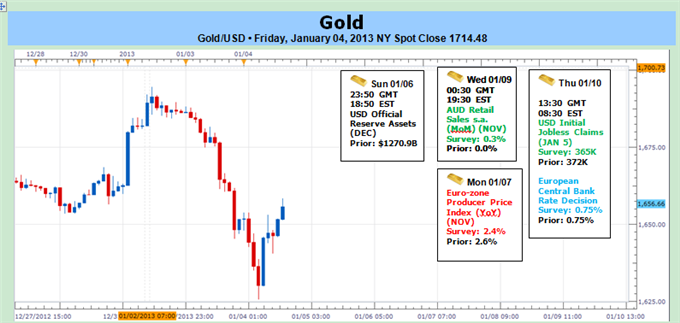

Gold prices were slightly softer at the close of trade this week with the precious metal off by just 0.27% to trade at $1650 at the close of trade in New York on Friday. It has been nearly three weeks since our last gold weekly forecast when we noted that, “Although this week’s rejection of $1723 (38.2% retracement from November advance) casted a bearish tone, bullion has continued to hold just above near-term Fibonacci support at $1693 with a break below this level (on a close basis) opening up the floor to further declines.” Indeed the level did give way with the break sparking the onset of a sell-off that took gold into key support this week at $1530 before making a sharp rebound on Friday on the back of a lackluster NFP print.

The FOMC minutes from the latest policy meeting released on Thursday weighed heavily on bullion which reversed course to close the day lower by more than 1.34%. The minutes showed that Fed officials see inflation risks as, “broadly balanced,” while noting that there is a broad consensus among voters to halt QE into the end of 2013. The most significant takeaway from the minutes was that, “almost ALL FOMC members saw potential QE costs as increasing.” For months we have noted that QE announcements have continued to see diminishing returns and with inflation concerns now beginning to take root, it will be difficult for the Fed to justify the use of additional easing measures.

These exact concerns were cited on Friday with Richmond Fed President Jeffrey Lacker expressing concerns over the central bank’s aggressive easing stance. Lacker noted that, “further monetary stimulus is unlikely to materially increase the pace of economic expansion, and that these actions will test the limits of our credibility.” Lacker, who is not a voting member this year, stressed that current policy raises inflationary risks and noted that, “accordingly, I see an increased risk, given the course the committee has set, that inflation pressures emerge and are not thwarted in a timely way.” As Fed members begin to strike a more neutral-tone for monetary policy, the greenback may continue to remain well supported with demand for gold expected to wane (at least in the near-term).

Non-farm payrolls released on Friday were largely in line with expectations with the economy creating a total 155K jobs in the month of December with private sector payrolls accounting for 168K jobs. Although the unemployment rate was upwardly revised (and held) at 7.8%, it’s important to note that the labor pool did expand with an increase in the participation rate likely to have contributed to the uptick in unemployment. With the Fed having already explicitly cited 6.5% as a threshold by which they would possibly begin to scale back on easing measures, continued improvement in the labor metrics may continue to weigh on expectations for more central bank stimulus and as such, we may see gold continue its recent decline.

From a technical standpoint, gold has seen a volatile start to the year with bullion prices surging back into the critical $1693 pivot level noted numerous times in 2012. This level represents the key 61.8% long-term Fibonacci extension taken from the December 2011 and 2012 lows. Note that the rallies seen off of the November and December lows seem to be in 3-wave corrections, suggesting that the broader bias here remains weighted to the downside with critical support seen at a near 4-way confluence of the 100% Fibonacci extension taken off the October high, the 61.8% retracement taken from the May advance and trendline support dating back to the May low at $1630. This level has served as a key pivot in price action dating back to 2011 and a reaction of some magnitude is expected. The yellow metal continues to hold within the confined of a clearly defined descending channel formation dating back to the October high with a break below $1630 eyeing support targets at $1600 and the 138.2% extension at 1585. Stronger support is seen in the region between $1550- $1555. Only a weekly close above $1693 invalidates our directional bias with such a scenario eyeing targets at $1700 and the 100-day moving average at $1714.

—written by Michael Boutros, Currency Strategist with DailyFX

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx