Danske Bank FX Strategy Research discusses EUR/USD outlook and argues that Cntral bank pricing appears increasingly aggressive and sees potential for eventually fading ‘reflation’ hopes to postpone expectations for a first ECB hike, while the case for a Fed March hike could stay alive for now.

"This should send EUR/USD firmly below 1.20 in Q1.…The USD index has continued to move lower in recent weeks and thus failed to react to the outlook for a more USD-positive policy mix. Several diverse factors have driven the USD recently, including turn effects and more aggressive pricing of a range of central banks

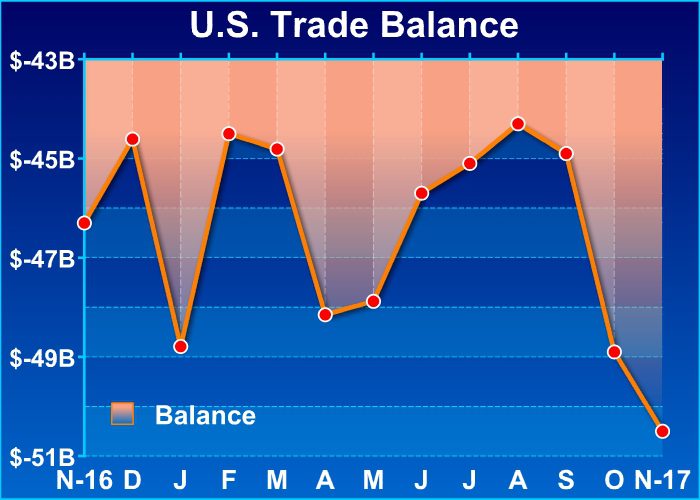

In addition, even if we could see some USD support from a lower repatriation tax and, more broadly, a boost to an already-strong US cyclical stance, we do stress that these USD positives could eventually be countered by the tax reform adding to the US ‘twin deficits’ (i.e. both the fiscal and current-account deficits are set to increase)," Danske argues.

Source: Danske Bank ResearchOriginal Article