Bank of America Merrill Lynch Technical FX Strategy Research discusses EUR/JPY outlook and notes its long-term triangle pattern is a trend bullish in 2018.

"Five leg trends in a long-term triangle describe EUR/JPY's trend since 2008. We think 4Q17 – 1Q18 will be leg "4?" (lower) and leg "5?"will continue higher in 2018

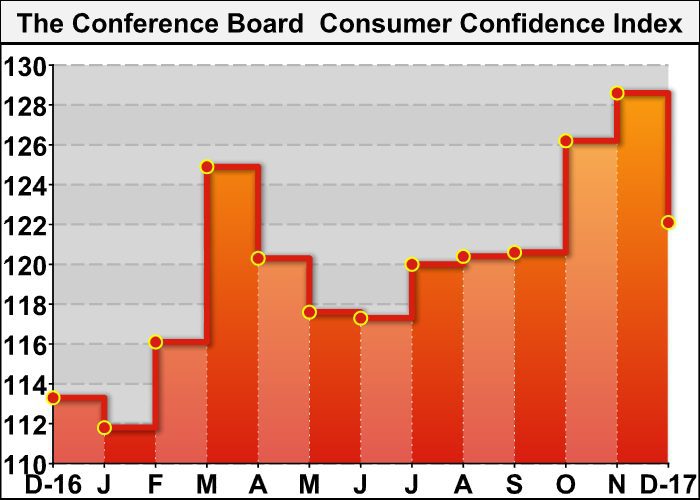

We think EUR/JPY will resume the fifth leg higher and reach the declining trend line in the 138-140 area. If EUR/JPY were to decline below the 38.2% level at 128.52, then our view may be at risk of a larger fourth leg correction than we currently anticipate and we would focus on the rising 12m SMA as support," BofAML argues.

"Technicals had favored entering long in the 128-130 area, however dips in Q4 thus far have been quickly bought in the 131's. Rising 12m moving average support, currently at 126.36, should hold to see through the 2018 uptrend," BofAML advises.

Source: Bank of America Merrill Lynch Rates and Currencies ResearchOriginal Article