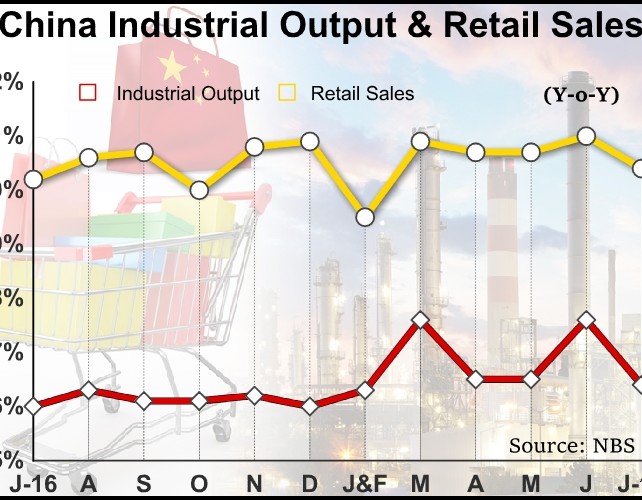

China's industrial output and retail sales grew at weaker rates at the start of the third quarter as measures to de-leverage the economy and cool property markets weighed on activity.

Data from the National Bureau of Statistics showed that industrial production grew 6.4 percent year-on-year in July, slower than the 7.6 percent increase in June and the expected 7.1 percent.

Production growth was largely driven by sectors like steel, while output of consumer goods and most other commodities weakened.

The strength in those areas that defied slowdown is unlikely to last given that policy tightening is set to further weigh on infrastructure and property investment in coming quarters, Julian Evans-Pritchard, an economist at Capital Economics, said.

Retail sales growth eased to 10.4 percent in July from 11 percent in June. Sales were forecast to advance 10.8 percent.

Although activity and spending came in below expectations, reversing most of improvement seen at the end of the second quarter, industrial production looks unsustainably strong given the growing headwinds to investment growth from policy tightening, the economist said.

Another report from NBS showed that fixed asset investment climbed at a slower pace of 8.3 percent during January to July from the same period of last year. Investment had advanced 8.6 percent in the first half of the year. Economists had forecast the growth rate to remain at 8.6 percent.

In the January to June period, real estate investment increased 7.9 percent from previous year.

Moody's Investors Service said on Monday that an increase in China's credit efficiency of growth is key to reducing leverage while meeting official growth targets and preventing a sharp increase in defaults.

The rating agency said that managing these policy trade-offs will mean sustainably reversing a trend in which progressively larger amounts of credit have been needed to generate any given amount of GDP growth that has been evident since the start of this decade.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News