Bubbles Don’t Deflate – they Burst. Watch for US Dollar Strength

Fundamental Forecast for US Dollar: Bullish

We’re witnessing the biggest Bond Bubble of a generation

US Treasury Bonds plummet and the US Dollar could gain further

Our proprietary sentiment data and trading strategies are buying USD dips

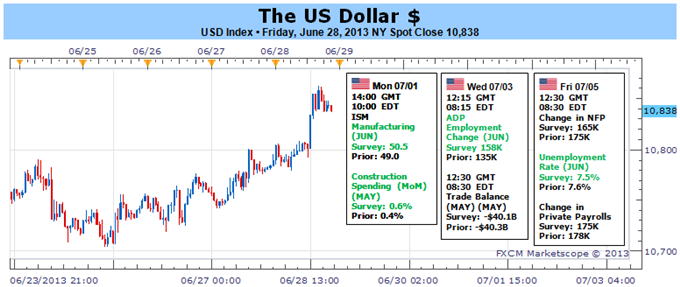

The Dow Jones FXCM Dollar Index (ticker: USDOLLAR) closed the quarter just short of two-year highs as an outright plummet in gold prices pushed the Greenback higher against commodity-linked currencies. All eyes now turn to a potentially pivotal week ahead as the European Central Bank and US Nonfarm Payrolls labor report will almost certainly bring further volatility across FX markets.

Traders sent the USDOLLAR higher through 9 of the past 10 trading days, and it can’t be a coincidence that the Dollar’s winning streak started on the US Federal Reserve’s June 18 meeting. It marked a substantial shift in the Federal Open Market Committee’s stance; FOMC Chairman Ben Bernanke made it clear that the central bank would look to “taper” its hyper-aggressive Quantitative Easing (QE) measures. Why is this significant?

The “QE Trade” effectively created the biggest bond bubble of a generation, and it seems fairly clear that Bernanke and Co. wanted to let some of the air out of that bubble. The problem is simple: even a small child with a bubble-blowing wand can tell you that there’s no such thing as a slow leak. Bubbles burst, and it’s never subtle.

Truly unprecedented sell-offs in US Treasury Bonds suggest the bubble has indeed burst, and the commensurate surge in yields is bullish for the US Dollar for many reasons. Indeed, those same reasons lead us to believe that the huge jump in forex volatility is just the beginning as things could get worse before they get better.

Of course the only thing that really matters in trading is time: when might we look to buy the high-flying US Dollar?

Our proprietary sentiment indicator and volatility-friendly trading strategies leave us plainly in favor of buying USD dips. We’ll look to a potentially pivotal week ahead for opportunities to buy those pullbacks in the USDOLLAR.

The combination of a European Central Bank rate decision and a highly-anticipated US Nonfarm Payrolls report will likely bring big moves. It’s worth noting, however, that the ECB decision lands on the US Independence Day and US markets will be closed. That fact could mean lower volatility or, perhaps more menacingly, exaggerated moves in the Euro/US Dollar and other currency pairs due to relatively limited forex market liquidity.

Consensus forecasts call for unchanged ECB monetary policy, but even a subtle change in rhetoric has the potential to shake financial markets. The Fed merely hinted at tightening policy and markets went berserk. And though the ECB is arguably closer to easing than tightening, President Mario Draghi sent the Euro flying higher as he struck a surprisingly hawkish tone through the bank’s June 6 meeting.

We think it’s fair to say Draghi won’t be doing that again; post-FOMC bond market panic actually hit European markets harder than in the US. But rest assured that the Euro and broader markets could see big moves if he fails to hint at negative interest rates or other unconventional easing measures.

Attention then turns to Friday’s NFPs release. US markets will be open, but many traders will take the long weekend off and there will be fewer people on hand to trade any surprises in the US labor market report. Consensus forecasts for NFPs are unremarkable as the US unemployment rate is expected to remain unchanged. But this marks the first real labor market data print since Bernanke dropped the “taper” bombshell. Reactions to surprises could be substantial.

It looks to be another big week for forex traders. And though there are no shortage of trading opportunities (at least in this author’s opinion), traders should likely use reduced leverage and trade defensively on what could be an eventful start to Q3 trading. – DR

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx