It seemed that traders hoped for more hawkishness out of yesterday’s released FOMC meeting minutes, especially given Fed Chair Yellen’s recent hawkish comments. Despite the lower enthusiasm however policymakers still made it clear that the next rate hike shall happen “very soon” as long as inflation and job data performed.

The USD’s initial knee-jerk reaction was lower, but lows for the US Dollar index (measuring the USD’s strength against a basket of currencies) were conatined well at 101.17 after day’s highs of 101.72. We are currently at 101.29.

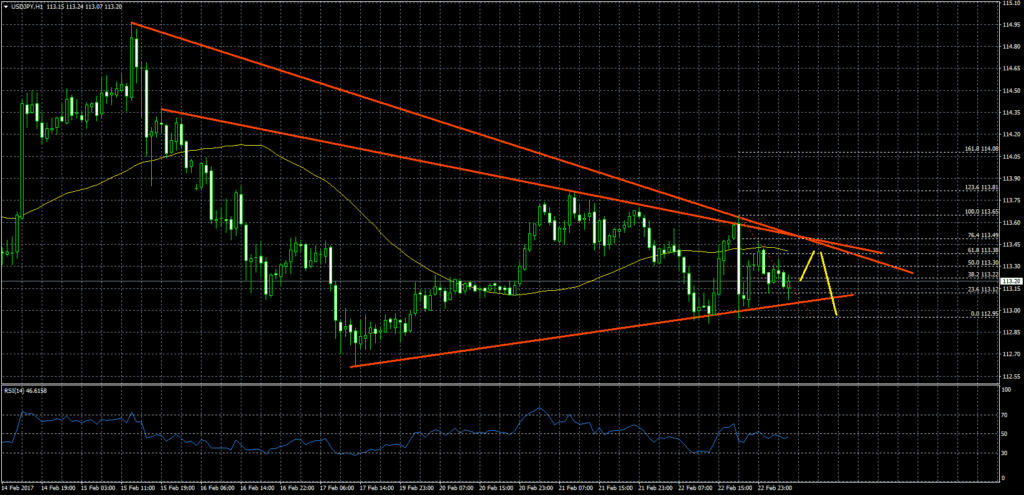

USDJPY dropped to session lows of 112.90 throughout yesterday’s session as the Yen found support against the USD. The currency pair is currently at 113.16 at the time of writing.

AUD took a beating this morning on the back of worse than expected Private Capital Expenditure which continued to shring bu a further 2.1% for the 4th Quarter, following an earlier decline of 4%. AUDUSD dropped to 0.7664 but has now almost recovered the overnight fall and is currently at 0.7699.