The Australian economy remains an outperformer in the G10 as it continues a successful transition away from a commodity-driven investment boom towards more consumption, exports and services-oriented growth. Indeed, Australia is experiencing the dividends from its previous half-decade of mining investment with net exports becoming a dependable contributor to growth. Also, despite the ramping up of global supply of iron ore and the fall in its price, iron ore prices remain well above the breakeven rates of Australia’s biggest producers.

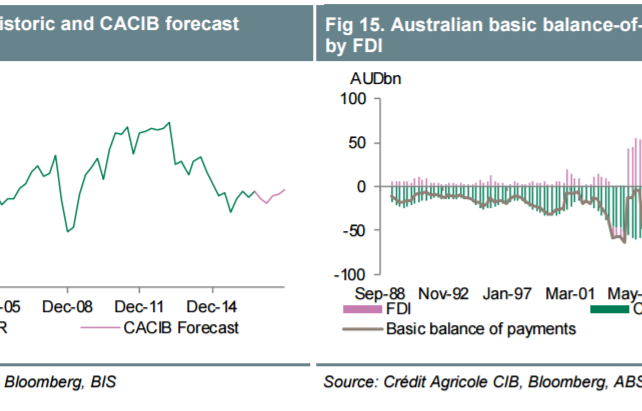

Australia’s economic outperformance is leading to capital inflows, which are supporting the currency. Investors are buying companies, infrastructure assets, commercial and residential real estate as well as long-end government bonds. Foreign direct investment into Australia is close to mining-boom highs, and Australia’s basic balance-of-payments balance is less of a drag on the currency.

RBA rate cuts are not likely to deter this investment, rather they would make the returns on many of these assets more appealing by boosting Australia’s already strong growth and providing temporary dips in the currency to buy into.

A sustained move by AUD/USD to 0.80 would likely generate another RBA rate cut, but we think that such a move is unlikely at this time. In the coming three months, we think that investors should buy dips in AUD/USD towards 0.74 and sell the exchange rate around 0.78. Above the latter level the market would begin to price in another RBA rate cut.

Copyright © 2016 Credit Agricole CIB, eFXnews™Original Article