Forex Free Trading Tips

Monthly archive July, 2017

CHF: What’s Behind The Heavy Selling? What’s Next? – BTMU

BTMU FX Strategy Research notes that CHF continues to slide and remains the stand-out mover in the FX markets with EUR/CHF moving from Monday’s intra-day low to today’s high, up some 3.3%.

"We can only put this down to Read More →

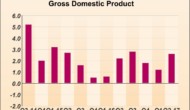

CHF weaker on interest differentials; USD enthusiasm after Thursday data fades, we now look onto US GDP

Sentiment from US session was mixed after Thursday’s close which saw the S&P and the Nasdaq lower. The mood turned even more sour for the Asian counterparts as the major equity indices there registered losses.

Some noticeably strong Durable Read More →

EURGBP – Euro To Break Declining Pattern Vs British Pound

Key Points

- The Euro after trading close to 0.8995-0.9000 against the British Pound started correcting lower.

- The EURGBP pair is currently following a descending channel pattern with resistance near 0.8940 on the hourly chart.

- Today in the Euro Zone, the Read More →

USD: July FOMC Was More Of An Excuse Than A Reason To Sell; What’s Next? – Credit Agricole

Credit Agricole CIB FX Strategy Research suspects that the July FOMC statement was more of an excuse than a reason to push the USD lower.

"Technical factors likely played a role as the EUR/USD rallied through the previous Read More →