GBP: Recovery Temporary And Unlikely To Last; How To Trade It? – SEB

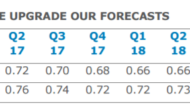

We are negative on the UK economy going forward although it did well in H2 last year. In particular household and capital spending seem vulnerable from the impact of growing political uncertainty created by the upcoming divorce from the EU. Read More →